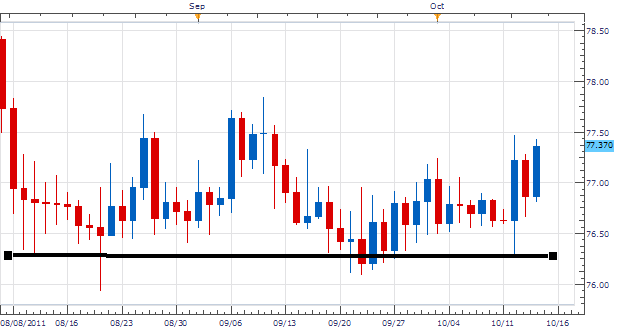

The USD/JPY has been planted in a range for months. Price has failed to trend by not making new lows or highs since August. Currently support lies at the August 19th low at 75.93. Resistance is established at the September 9th high of 77.84, completing our 191 pip range. Traders have multiple options here, looking for either a breakout or for range bound conditions to continue.

Fundamentally, both of the Dollar and Yen have been competing as safe haven assets. This has caused both to make gains against other currencies. It would be reasonable to expect this trend to continue however, Japanese officials have taken a stand stating that they will be taking steps against a strong Yen. This is exactly the catalyst that we are looking for to potentially break the USD/JPY from its range.

Taking Price in to a 4Hour chart we can see our established support and resistance lines. Using the news as catalyst traders can begin placing entry orders for a breakout. Entry’s should be placed over the previously discussed September high of 77.84. Traders preferring to trade manually may look for a candle close above this level.

My preference is to buy a breakout of the USD/JPY over previous highs. Entry’s should be placed over the 78.00 figure with Stops should be placed at half the distance of the previous range at 77.00. Limits should look for a minimum 200 pip gain for a clear 1:2 risk/reward ratio.

Alternative scenarios include price continuing to range between established support and resistance

Additional Resources

--- Written by Walker England ,

To contact Walker , please email Instructor@DailyFX.Com. You can follow on Walker onTwitter @WEnglandFX.

To be added to Walkers’ distribution list, please send an email with the subject line “Notification,” to WEngland@fxcm.