The BIG Idea on the Short EUR/CAD trade:

A fusion of Elliott Wave chart patterns and an increasing premium growing for out the money puts on EUR/CAD makes a short EUR/CAD trade worth considering. A break below 1.5200 may show that a retracement of to the May 30 low at 1.4917 or possibly to the YTD low at 1.4818 could be in play with technical risk well defined.

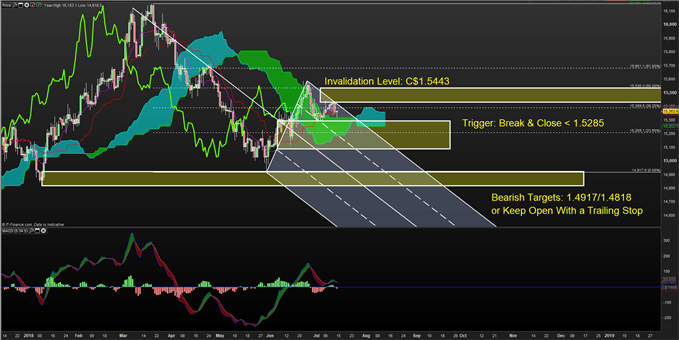

- Point to Establish Short Exposure: Break & close below 1.5285

- Spot: 1.5365 Canadian Dollars per Euro

- Target 1: 1.4917 CAD per EUR (May low)

- Target 2: 1.4818 CAD per EUR, or keep open with Trailing Stop (YTD low)

- Invalidation Level: 1.5443 CAD per EUR (July Opening Range high)

If you are looking for other strong trading ideas, you may enjoy our FREE Trading Guides

The BIG Picture on EUR/CAD:

Chart Source: Pro Real Time with IG UK Price Feed. Created by Tyler Yell, CMT

The trend looks to have shifted for EUR/CAD, and there could still be more for the taking on the downside. Three specific ways of looking at the market have caught my attention: First, option premiums via Risk Reversals are showing the largest put (or downside protection) premiums over 1-week and 1-month for EUR/CAD than any other currency pair in over 30 G10 and crosses. Such a premium would anticipate a sharp downside move in EUR/CAD is anticipated more than in any other pair accounting for implied volatility.

Second, the Elliott Wave pattern from the March high to the May low was impulsive in nature. This development would favor the recent 50% bounce as corrective, which could be followed by another impulsive downside move. The follow through is what would likely cause EUR/CAD to hit the two bearish targets if the options premiums for a downside move play out.

The MACD 5,34,5 setting on the chart below also shows that we could soon extend lower as the MACD line has once again broken below the signal line

Lastly, Ichimoku is a trend following indicator that I only appreciate more so with experience. On a daily chart, which I have above, you can see the lagging line (bright green) is still below the cloud. As such, momentum is bearish until the lagging line is above both prior price and the cloud.

All things being equal, should price break below 1.52875 and close below, it would show a definitive bearish momentum development with the lagging line below both prices from 26-periods ago and the respective cloud.

One key thing that Ichimoku teaches traders is not to fight the trend, and this development would show a bearish trend would likely be in play. If the price in EURCAD breaks below the YTD low at 148.18, traders could see a move toward the late 2017 low of 1.44 CAD per EUR.

Access our popular free trading guides to enhance your trading strategy here.

---Written by Tyler Yell, CMT

Tyler Yell is a Chartered Market Technician. Tyler provides Technical analysis that is powered by fundamental factors on key markets as well as t1rading educational resources. Read more of Tyler’s Technical reports via his bio page.

Communicate with Tyler and have your shout below by posting in the comments area. Feel free to include your market views as well.

Discuss this market with Tyler in the live webinar, FX Closing Bell, Weekdays Monday-Thursday at 3 pm ET.

Talk markets on twitter @ForexYell