Point to Establish Short Exposure: Breakdown below 75.50cents per AUD

Spot: 76.07 cents per AUD

Target 1:73.30 (May 8 low)

Target 2: 71.45 US cents per AUD (May ’16 low)

Invalidation Level: 77.28 cents per AUD (50DMA)

If you are looking for other strong trading ideas, you may enjoy our FREE Trading Guides

The Australian Dollar continues to disappoint bulls who were hoping record levels in equity markets would equate with a similar buying of carry trade currencies (i.e., high-yielding currencies) like the Australian and New Zealand Dollar.

On Tuesday morning, the RBA led by Philip Lowe poured cold water on possible reasons why they may turn hawkish that could lift the Australian Dollar in the short term. After keeping the rate on hold at 1.5% for the 15th straight meeting, the central bank communicated that they see little reason to suggest the rate should be higher as wage growth in AU is expected to stay low and that the relatively strong AUD is likely limiting a pickup in inflation and the economy.

While the US Dollar has not been a stellar performer, the prospects for the Dollar gaining against the Australian Dollar align with what is shown on the chart with a series of lower highs since early September and also through correlated metals markets. Metals have taken a hit at the open of December on the fear that Chinese YoY demand growth is slowing providing Copper with its largest drop in 2-years on December 5.

The trade would like to take advantage of a continuation of the downtrend on a bearish impulsive breakdown. The signaling level that this trade may be working out would be if the price breaks below 75.50. The initial stop or idea invalidation would be at 0.7730 for target 1 and 0.7900 for target 2.

A counter argument for the trade is that there has been a recent premium shown for options over 1-month protecting against gains in AUD/USD. However, the correlation of spot to the risk: reversal ratio has fallen to +. 0.2 with 1.0 being the strongest postive correlation.

Access our popular free trading guides to enhance your trading strategy here.

AUD/USD Chart with resistance at 77.54 outlined:

Chart created by Tyler Yell, CMT

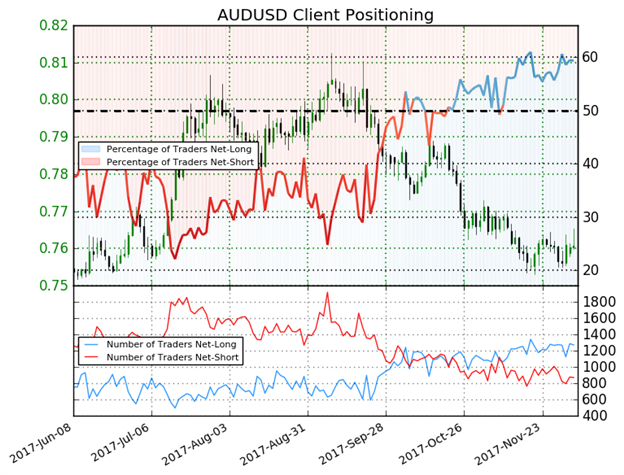

IG Client Sentiment Highlight: Australian Dollar Set to Fall on Bearish Bias

AUDUSD: Retail trader data shows 59.3% of traders are net-long with the ratio of traders long to short at 1.46 to 1. In fact, traders have remained net-long since Nov 10 when AUDUSD traded near 0.76537; price has moved 0.6% lower since then. The number of traders net-long is 3.7% higher than yesterday and 0.6% higher from last week, while the number of traders net-short is 4.4% lower than yesterday and 19.1% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUDUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUDUSD-bearish contrarian trading bias (emphasis added.)

Written by Tyler Yell, CMT