The rebound in the USD has caught many off guard. The institutional short position in DXY at the end of September was the largest since 2013 when looking at leveraged funds (i.e., hedge funds). This breakout came at poor timing as the DXY is working on the highest close since late July and names are entering the short list of Fed successors that may bring a new hawkish view to a team blamed of dovish groupthink in the post-crisis era.

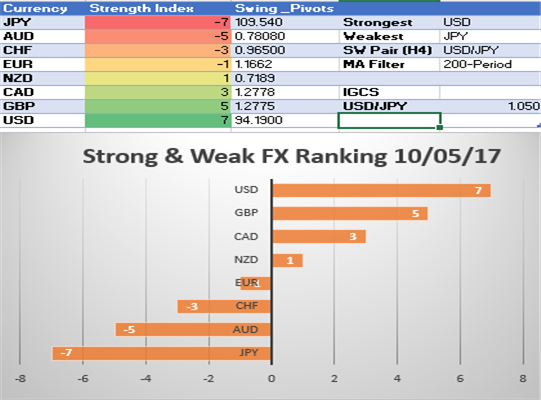

These signals align for the potential of further USD strength, especially against weaker FX like the Japanese Yen. The Japanese Yen has been the weakest currency on a relative basis over the last few weeks. Recently, the stubbornness of JPY to weaken further has been blamed on options bought for JPY advancement ahead of the October 22 election in Japan. However, an Abe victory, which polls are favoring would likely see those options expire worthless, and a potential all-clear sign for further JPY weakness as equities in the US are working on their longest consecutive day over day rally since 2013.

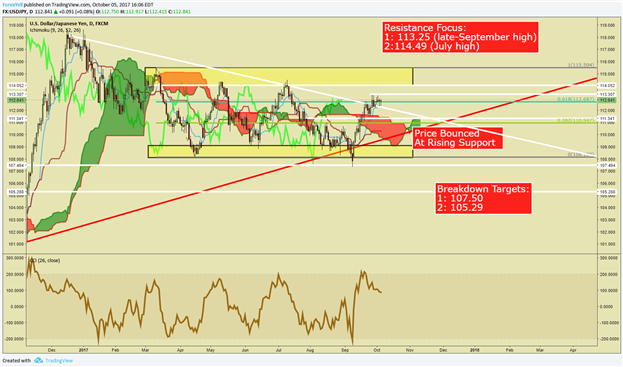

Also, September saw a bullish key month in USD/JPY where the close of September was above the August high, and the low of September was below the August low showing an engulfing candle with a Bullish finish.

Access our popular free trading guides to enhance your trading strategy here.

The two bullish triggers to watch would be a break above 113.26, the recent high and 114.50 the July high. A break above these levels along with a continuation of the USD-bullish theme would likely bring a move to the March high of 115.50 if not a longer-term shift to JPY weakness and USD strength, which would align with the common play in the fourth quarter for USD going back to 2011.

USD/JPY Chart with Resistance outlined:

October 5 Strong/Weak Ranking (H4 Chart, 200-MA) – JPY Weakest / USD Strongest

---

Written by Tyler Yell, CMT