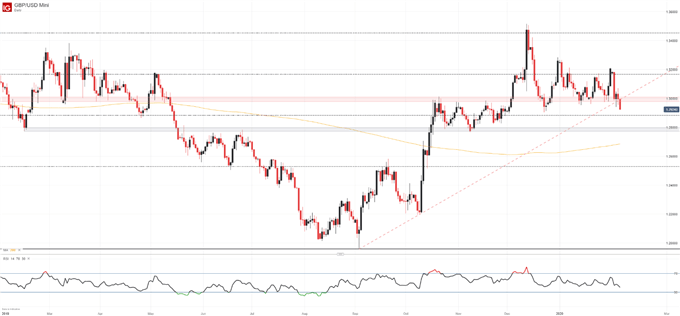

GBP/USD Price Outlook:

- GBP/USD suffered a break beneath support on Thursday as sellers remained in control

- Should British Pound weakness persist, GBP/USD may look to test subsequent support around 1.28

- IG Client Sentiment Data reveals retail traders remain overwhelmingly long GBP/USD, a potential sign of further bearishness

British Pound Price Forecast

Cable has suffered a string of losses in recent weeks, falling from 1.3252 at the start of the year to as low as 1.2927 this week. In between the two price points, GBP/USD repeatedly probed the 1.30 area which provided support until an eventual break was posted on Thursday. With confluent support in the rearview, Sterling could look to extend its decline to subsequent support in the days to come.

GBP/USD Price Chart: Daily Time Frame (February 2019 – February 2020)

That being said, the pair should enjoy an early opportunity for a modest bounce if the Fibonacci level around 1.2880 can provide buoyance. While it has worked to stall price action in the past, its influence was somewhat underwhelming in October and November - when GBP/USD last traded near current levels. Therefore, the pair may be vulnerable to further declines that would leave the 1.28 area in focus.

The zone originates from Sterling’s April 2019 swing low and has previously displayed an ability to stall directional moves. Therefore, GBP/USD bears may be given pause if the level is threatened. Nevertheless, a break beneath horizontal support would open the door for a deeper pullback, potentially targeting the 200-day simple moving average around 1.2687.

| Change in | Longs | Shorts | OI |

| Daily | -2% | -7% | -4% |

| Weekly | -5% | 5% | -2% |

While Cable looks to regain its footing, IG Client Sentiment Data suggests further losses may be in store as the vast majority of retail traders are net-long. In the meantime, follow @PeterHanksFX on Twitter for updates and analysis.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX