Australian Dollar Outlook:

- The Australian Dollar may enjoy a bullish boost from improving US-China trade relations

- Still, topside resistance is plentiful, and the technical barriers will look to keep a lid on AUDUSD gains

- With the uncertain backdrop, IG Client Sentiment Data may provide the confirmation needed to trigger an entry

Australian Dollar Outlook: Awaiting Bullish Confirmation from Client Sentiment

The Australian Dollar has enjoyed a rebound off support since early October and has recently been gifted another bullish driver with the improvement in US-China trade relations. Given the Australian economy’s relationship with China, any indication that the outlook for Chinese economic growth is improving could translate to higher Australian exports, therefore buoying the economy and potentially resulting in a more hawkish RBA. While the fundamental landscape appears to be shifting in the Australian Dollar’s favor, there are still considerations to be had.

AUDUSD Price Chart: 1 – Hour Time Frame (October – November) (Chart 1)

The first of which is the simultaneous impact on the US Dollar. A tangible improvement in the US-China trade war would be viewed as a positive development for the US economy – as a key headwind is reduced. In turn, the Fed may become more hawkish as the case for further rate cuts weakens and the US Dollar is strengthened. Thus, AUD bulls will have to hope the resultant impact on the Australian economy outpaces that of the US economy – allowing for AUDUSD to climb.

AUDUSD Price Chart: Daily Time Frame (October – November) (Chart 2)

The second and more visible concern is nearby technical resistance. Continuing its rally from support around 0.67, AUDUSD is fast approaching a convergence of topside barriers. Most notably, the 200-day simple moving average, which resides narrowly above the trading price at the time of posting. Secondarily, a descending trendline from December 2018 will look to align with horizontal resistance from July to keep AUDUSD in check. Together, the three technical barriers will look to offer a formidable defense – but could also provide support in the event they are surmounted.

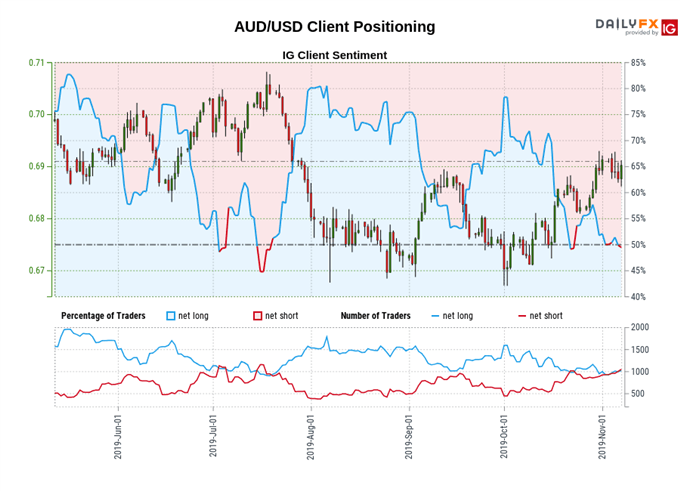

With valid arguments on either side of the Australian Dollar’s outlook, it may prove wise to await a bullish confirmation from IG Client Sentiment Data. As it stands, bulls and bears are effectively deadlocked – delivering an all-too-familiar mixed signal on AUDUSD. Nevertheless, if retail traders look to increase their short exposure around this area of confluent resistance and outpace bullish interest, the contrarian nature of the data could signal a larger uptrend is due to emerge. Such a trend would offer a continuation from the October lows.

With that in mind, initial areas of interest to the topside will reside around 0.70. The level has proven its ability to influence price in the past and it may look to do so again. Should the pair stall at this level, it may signal the top of a false breakout. Thus, surpassing this level would amount to a very encouraging development for AUDUSD.

On the other hand, an area of invalidation for the trade will reside near the pair’s 2016 low at 0.6827. A break beneath this area could suggest AUDUSD is destined for another retest of support around 0.67 and would erode a bullish outlook in the shorter-term.

In summation, AUDUSD looks to be perched on a knife’s edge and IG Client Sentiment data could provide the deciding confirmation for a bullish continuation higher if short interest can outpace bullish exposure. To learn more about retail data and how to incorporate it into your trading strategy, sign up for my weekly walkthrough webinar. While retail clients battle it out and I await confirmation, follow me on Twitter @PeterHanksFX for further updates and analysis.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX