CAD/JPY Highlights:

- CAD/JPY forming a bear-flag pattern

- Canadian dollar has acted with some continuity

A lot of the volatility in the FX market has been erratic, but in some spots there are still some nice technical sequences to pay attention to. CAD having had a big breakdown versus USD is trading relatively well, which brings us to CAD/JPY despite the volatility price action in JPY.

CAD/JPY on the hourly chart is putting in a fairly consistent pattern in the way of a bear-flag. It is currently sitting on the lower parallel of the pattern, but with a break of 7529 the bearish implications of the pattern should start to get realized.

The stop on these types of patterns is typically best placed sufficiently inside the pattern, so in this case around 7700 could make for a good spot. Looking lower to potential targets, first up as support is 7386, followed by the 2011 low at 7215, and then if things turn really south, the 2009 low at 6837.

Remember to keep risk in check during these extraordinarily volatile times by trading with smaller than normal size. And as always, be disciplined with stop losses.

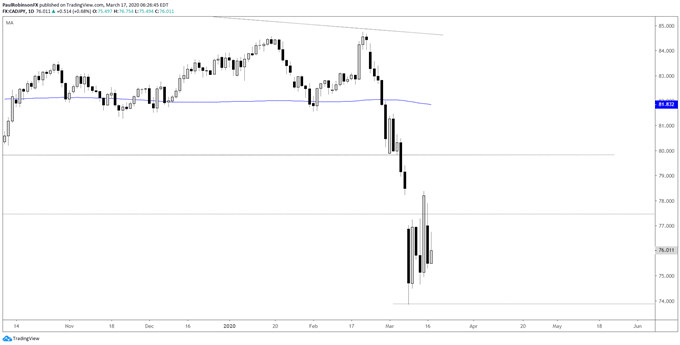

CAD/JPY Daily Chart (pointed lower)

CAD/JPY Hourly Chart (bear-flag)

***Updates will be provided on the above thoughts and others in the trading/technical outlook webinars held at 1030 GMT on Tuesday and Friday. If you are looking for ideas and feedback on how to improve your overall approach to trading, join me on Thursday each week for the Becoming a Better Trader webinar series.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX