USD/MXN Highlights:

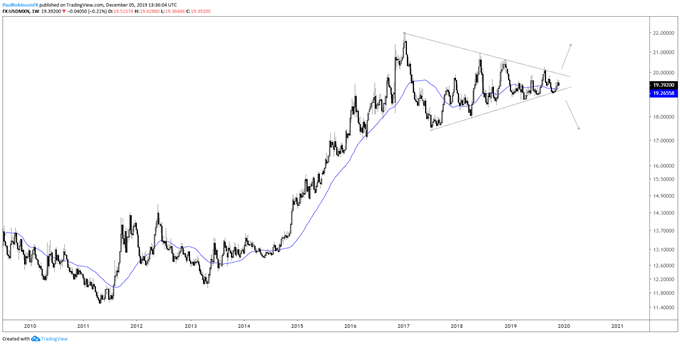

- USD/MXN macro-triangle nearing the apex and thus a breakout

- Higher or lower> Just follow the break and go from there…

It may not be long before the US Dollar undergoes a massive breakout versus the Mexican Peso. For nearly three long years USD/MXN has been undergoing a contraction in price swings that is resulting in a macro-sized triangle.

The coiled-up nature of the chart is unsustainable and suggests that at the very least we see a substantial pick-up in volatility. It might not be a clean breakout, but it looks like traders need to be ready and geared up to take advantage of more fertile trading conditions.

From a tactical standpoint, will initially run with whichever way USD/MXN breaks, using the August swing-high 20.2561 as bullish confirmation and the October low of 19.0176 as bearish confirmation. Based on the broader trend (up), a top-side resolution is seen as the most likely outcome.

Based on the size (height) of the formation, a substantial move of 4 full points could develop, that is ~24 on the upside or 15 on the downside.

While the majority of traders won’t be looking to hold for the duration of the trade, given it could be measured in years, a trading bias can still be used to determine short-term maneuvers – i.e. long bias look for short-term bullish consolidations or pullbacks to support on the daily/4-hr time-frame, and vice versa for shorts.

Trading Forecasts and Educational Guides for traders of all experience levels can be found on the DailyFX Trading Guides page.

USD/MXN Weekly Chart (massive wedge nearing apex)

USD/MXN Daily Chart (watch confirmation levels)

***Updates will be provided on the above thoughts and others in the trading/technical outlook webinars held at 1030 GMT on Tuesday and Friday. If you are looking for ideas and feedback on how to improve your overall approach to trading, join me on Thursday each week for the Becoming a Better Trader webinar series.

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX