EUR/USD Price, Chart, and Analysis

- EUR/USD - the path of least resistance remains lower

- US Dollar strength may drive EUR/USD back below 1.1000.

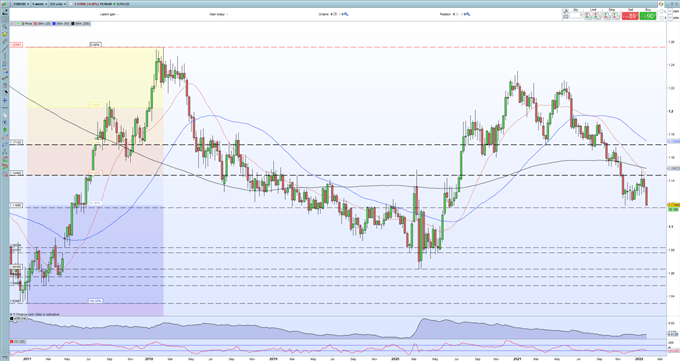

The latest FOMC monetary policy meeting has given the already strong US dollar another leg higher and pushed various USD pairs to multi-week or multi-month lows. One of these pairs, EUR/USD, is now pressing down on multi-week support and if this is broken conclusively would see the pair back at levels seen last in June 2020 and at an important Fibonacci retracement level.

EUR/USD is changing hands at 1.1190 and just above the late-November 1.1185 print. If this is broken, and it looks likely that it will be, then the 61.8% Fib retracement at 1.1182 will also fall. Below here support levels become a little bit harder to pinpoint with a mini swing-low at 1.1168 the only real line of resistance before sub-1.1000 levels come into play on the weekly chart. Big figure support may prevent a break below 1.1000 in the short-term but with fundamentals favoring further US strength, this level may fall in the medium-term as the yield differential between the two currencies widens. The recent run of weekly higher lows has been destroyed this week by Jerome Powell, adding another bearish layer to the weekly chart.

It may be prudent to wait a while before entering any short EUR/USD trade to see if there is any correction to the latest, sharp, sell-off. A bounce back to the 1.1250-1.1300 area would give traders a much better entry point for a medium-term sub-1.1000 trade.

EUR/USD Weekly Price Chart January 27, 2022

Retail trader data show67.01% of traders are net-long with the ratio of traders long to short at 2.03 to 1. The number of traders net-long is 13.80% higher than yesterday and 5.34% higher from last week, while the number of traders net-short is 16.30% lower than yesterday and 14.66% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

| Change in | Longs | Shorts | OI |

| Daily | -10% | -4% | -8% |

| Weekly | -13% | 35% | 0% |

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.