The DailyFX Q2 2019 Forecasts are now available to download including our forecasts for GBP and EUR.

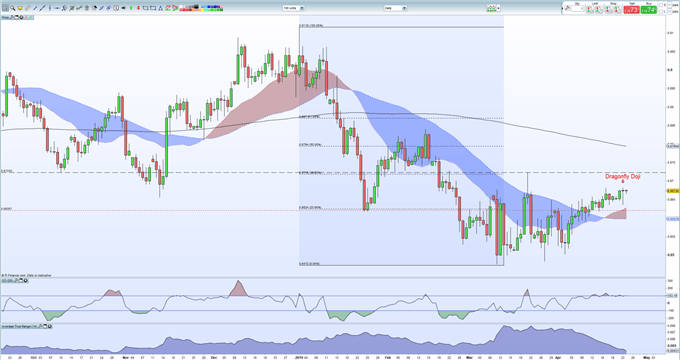

EURGBP continues to move slowly higher and continues to eye the 38.2% Fibonacci retracement level at 0.87180, just before the March 21 ‘spike’ high at 0.87233. If the pair can break and close above here – and it will probably take a fundamental shift to confirm this – then the pair will run into heavy resistance around 0.87940, where the 50% Fibonacci resistance crosses with the 200-day moving average.

On the chart an interesting ‘dragonfly doji’ was made on April 23, a candle formation that may give EURGBP a short-term uplift. The long tail/lower shadow on the candle shows that while sellers tried to push the price lower, buyers stepped-in and took control of price action. The low made at 0.86355 may well be a short-term base.

EURGBP bears may point to the overbought nature of the market with the CCI indicator still trading either side of 100, an indication of a potentially overheated market. The ATR indicator at the bottom of the chart shows how tight trading ranges have become since early April with an average daily range of just 43 pips. While this shows how tight the market has become, it may also be an early warning that any fundamental market shift may cause an out-sized market reaction when stops get taken out.

EURGBP Levels to Note:

To the upside – 0.87180, 0.87233 and 0.87940.

To the downside – 0.86355, 0.86240 and 0.85910.

EURGBP Daily Price Chart (September 2018 – April 24, 2019)

IG Client Sentiment Data shows how retail investors are positioned in a range of currencies and asset markets and how daily and weekly positional changes shift sentiment. See how this affects EURGBP.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on EURGBP – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.