Check out our New Q3 Trading Forecasts: they’re free and include our latest analysis on USD, CAD and Oil – all important drivers of USDCAD.

- US dollar to get a Hawkish Fed boost.

- Long-term moving average remains bullish, Fibonacci gives support.

*** Update August 6, 2018 – -- Going Flat on USDCAD ***

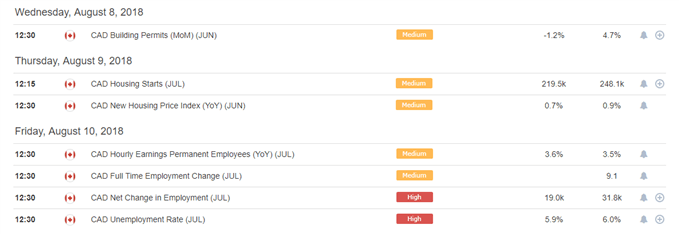

We have cut are USDCAD position – roughly no cost – and will remain on the side-lines until both technical and fundamental indicators take a more positive tone. While we still believe in the position in the medium-term, in a shorter time-frame better entry levels may be available. We would like to see how the pair react to a test of the 1.2952 Fibonacci retracement level which opens 50% retracement at 1.2818 and the 200-day moving average at 1.2830. From a fundamental point of view, the US dollar rally remains intact, but upside momentum is slowing while the Canadian dollar is gradually gaining strength as the market continues to price in an interest rate hike by the end of the year. We also have important data from mid-week onwards, culminating with Friday’s jobs data.

Original Story

USDCAD Rebound to Take Shape

USDCAD is set to turn higher, driven by US dollar strength and a lull in the price of oil. US Treasury yields provide a solid foundation for the greenback and are set to move even higher over the next few weeks with the FOMC fully expected to hike interest rates, for the third time, by 0.25% at the September meeting. Ahead of that, today’s FOMC meeting will give Fed Chair Jerome Powell an opportunity to underline the strength of the US economy with Q2 growth in excess of 4% while US unemployment remains at a multi-decade low. The 2-year US Treasury currently yields a near-decade high of 2.675%, while the 10-year UST is a couple of basis points under the psychological 3%. Further, renewed trade war fears – and the impact of a slowing global economy - will weigh on the price of oil, an important driver of the Canadian dollar.

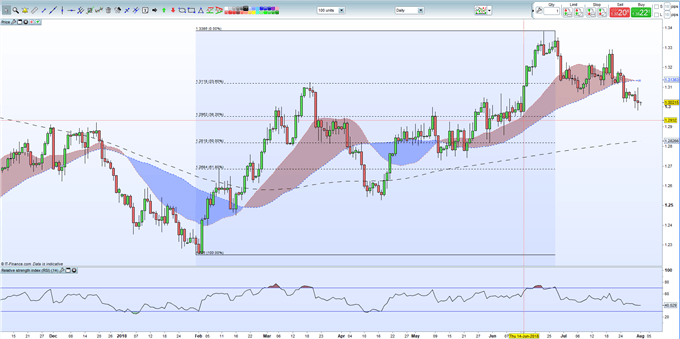

USDCAD currently trades around 1.3020, having broken below the 1.3000 level this week, prompting market headlines. The pair however traded straight back above this level which is protected on the downside by the 38.2% Fibonacci retracement level at 1.2952. USDCAD trades just below the 20- and 50-day moving averages but above the long-term 200-day ma, currently at 1.2825. A second level of Fibonacci support, the 50% retracement, sits at 1.2820.

Short-term upside targets are situated between 1.3118 and 1.31365 – 23.6% Fibonacci and 20- and 50-day moving averages. After this the July19-20 double top at 1.3290 comes into view.

USDCAD Daily Price Chart (November 2017 – August 1, 2018)

Entry Point: 1.3020

Target 1: 1.31365 (50-day moving average)

Target 2: 1.3290 (July 19-20 double top)

Stop-Loss: 1.2920 (below 38.2% retracement)

You may like to look at our Free Trading Guides which include Building Confidence in Trading, the Number One Mistake Traders Make and Top Trading Lessons, important pre-trade information.

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1