- Updated levels on trade setup we’ve been tracking in USD/CAD and AUD/USD

- Join Michael for Live Weekly Strategy Webinars on Mondays on DailyFX at 12:30 GMT (8:30ET)

- Check out our 2018 projections in our Free DailyFX USD Trading Forecasts

Review this week’s Strategy Webinar for an in-depth breakdown of this setup and more.

USD/CAD 240min Price Chart

In my most recent USD/CAD Price Outlook we noted that, “The Canadian Dollar largely remains within the confines of a broader consolidation pattern just below key resistance,” with our broader focus on a break of the, “1.3298-1.3437 range for guidance.” Price challenged the lower bounds of this zone today with a recovery taking Loonie back into monthly open resistance at 1.3345 – the weekly OR is set.

Today’s defense of support keeps the focus on a break of the broader consolidation pattern with the monthly opening-range still intact heading into US / Canada retail sales data tomorrow. A topside breach targets 1.3467 backed by the 78.6% retracement at 1.3537. A break lower exposes 1.3234/48- look for a bigger reaction there IF reached. Review my latest USD/CAD Weekly Price Outlook for a look at the longer-term technical trade levels.

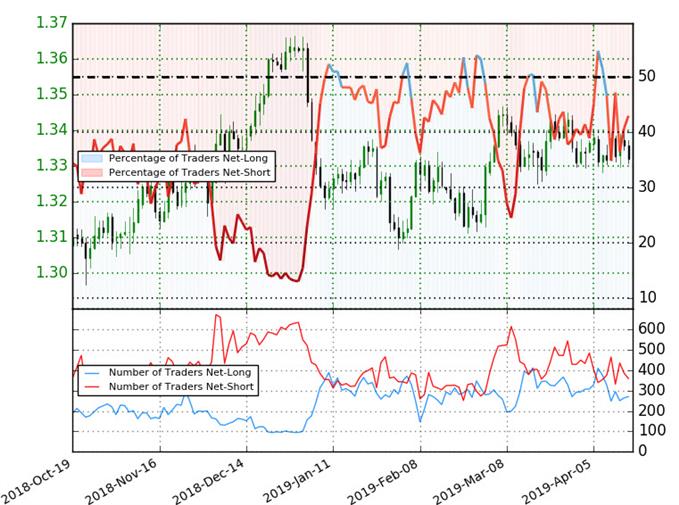

USD/CAD Trader Sentiment

- A summary of IG Client Sentiment shows traders are net-short USD/CAD - the ratio stands at -1.33 (42.9% of traders are long) – weak bullish reading

- Traders have remained net-short since April 10th; price is unchanged since then

- Long positions are 8.4% higher than yesterday and 28.2% lower from last week

- Short positions are22.3% lower than yesterday and 0.3% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/CAD prices may continue to rise. Yet traders are less net-short than yesterday but more net-short from last week and the combination of current positioning and recent changes gives us a further mixed USD/CAD trading bias from a sentiment standpoint.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

AUD/USD 240min Price Chart

In our last Aussie Price Outlook, we noted that AUD/USD was, “trading into a near-term technical resistance confluence and while the immediate advance is vulnerable heading into the close of the week, a break of the monthly opening range does keep the broader focus higher in price while above the monthly open.” A brief stint above the 200-day moving average at ~7194 failed today with Aussie slipping back below the weekly open ahead of Australian employment data later tonight.

A break below April channel support would risk a larger set-back in Aussie with such a scenario targeting the monthly open at 7122 backed by the 61.8% retracement at 7111 and the highlighted confluence zone around ~7086- look for a bigger reaction there IF reached. Resistance stands at 7216/18 with a breach / close above 7233 needed to fuel the next leg higher in price targeting 7270/75. Review my latest AUD/USD Weekly Price Outlook for a look at the longer-term technical trade levels.

Find yourself getting trigger shy or missing opportunities? Learn how to build Confidence in Your Trading

New to Forex? Get started with our Beginners Trading Guide !

-Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex