- Update on trade setup we’ve been tracking inEUR/USD and USD/CHF

- Join Michael for Live Weekly Strategy Webinars on Mondays on DailyFX at 12:30 GMT (8:30ET)

- Check out our 2018 projections in our Free DailyFX Trading Forecasts

New to Forex? Get started with our Beginners Trading Guide !

EUR/USD 120min Price Chart

We’ve been tracking the reversal in Euro for the past two weeks with the ‘bottom line’ for our most recent EUR/USD scalp report noting that rice had, “extended higher for the third consecutive day and from a trading standpoint, we’re looking for near-term weakness to offer more favorable long-entries while within this near-term formation. Look for a bigger reaction on a rally into key near-term resistance at 1.1780/90.”

Price registered a high this week at 1.1734 before breaking (and retesting) channel support late in the week. The immediate risk remains for further losses but we’re looking for a near-term low heading into the start of the month. Interim support rest at 1.1568 and IF Euro is indeed heading higher, losses should be limited by 1.1510/30 (bullish invalidation). Resistance still 1.1691 with a breach above 1.1790 still needed to fuel the next ‘leg’ higher in price. Review this week’s Strategy Webinar for an in-depth breakdown of this setup and more.

Learn the traits of a successful trader in our Free eBook!

USD/CHF Daily Price Chart

We highlighted the potential for a breakout trade in Swissy earlier this month with the subsequent decline in USD/CHF taking out targets at 9846 and 9784 this week before continuing lower. Price rebounded off the lower 50-line today with momentum in oversold territory.

The risk is for some recovery here but heading into the start of the month, I’m looking for exhaustion on a move towards 9733/44 for possible re-entry on the short-side targeting confluence support a 9629. Ultimately, a breach above the sliding parallel (red) / June low at 9788 (bearish invalidation) would be needed to shift the focus back the topside.

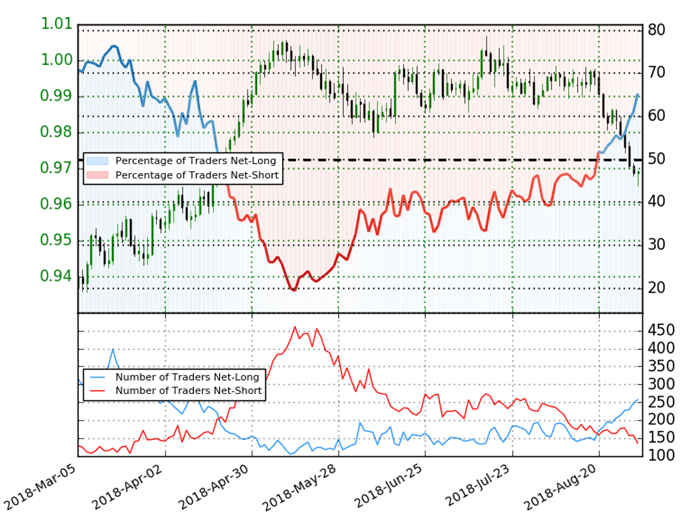

USD/CHF Trader Sentiment

- A summary of IG Client Sentiment shows traders are net-long USD/CHF - the ratio stands at -1.88 (65.3% of traders are long) –bearishreading

- Traders have remained net-long since August 21st; price has moved 1.6% lower since then

- The percentage of traders net-long is now its highest since March 21st

- Long positions are2.3% lower than yesterday and 26.5% higher from last week

- Short positions are 18.9% lower than yesterday and 22.6% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CHF prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current positioning and recent changes gives us a stronger USD/CHF-bearish contrarian trading bias from a sentiment standpoint.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Find yourself getting trigger shy or missing opportunities? Learn how to build Confidence in Your Trading

-Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex or contact him at mboutros@dailyfx.com