- Update on trade setup we’ve been tracking in EUR/USD and AUD/JPY

- Join Michael for Live Weekly Strategy Webinars on Mondays on DailyFX at 12:30 GMT (8:30ET)

- Check out our 2018 projections in our Free DailyFX Trading Forecasts

New to Forex? Get started with our Beginners Trading Guide !

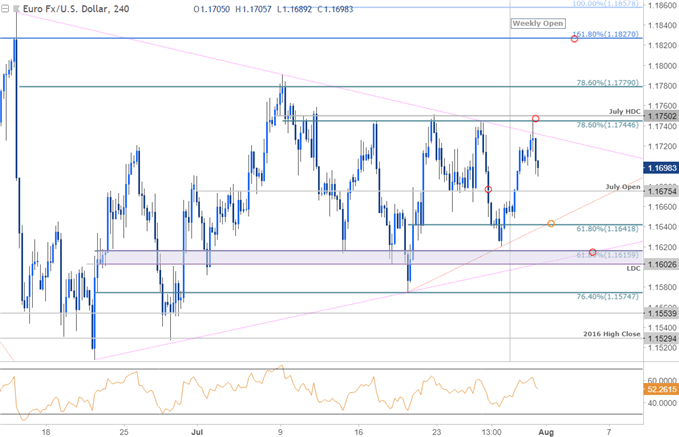

EUR/USD 240min Price Chart

Earlier this month we highlighted weekly support confluence in EUR/USD with price remaining within the confines of a broad consolidation pattern after multiple failed attempts to break lower. The immediate focus is on a breakout of this consolidation range and we need price to clear the 1.1603-1.1750 for guidance (topside favored). From a trading standpoint, I’ll favor fading weakness near-term while above 1.1642- Intraday trading levels remain unchanged from this week’s EUR/USD Technical Outlook.

Learn the traits of a successful trader in our Free eBook!

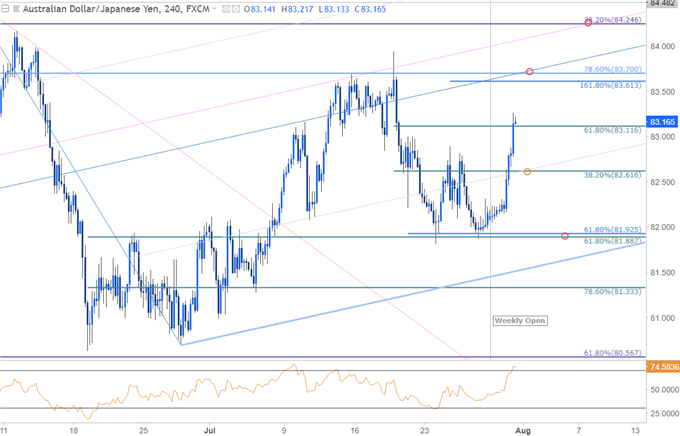

AUD/JPY 240 Price Chart

In my previous analyst pick, we examined a reversal that was underway in AUD/JPY with our focus, “lower while below the weekly open at 83.24 with initial support objectives eyed at the confluence of the 50-line / 100-day moving average at ~82.50 and the 61.8% retracement / July open at 82.00/04- look for a stronger reaction there for guidance. “

A ‘strong’ reaction off the 82-handle has fueled a price rally of more than 1.7% with the advance taking AUD/JPY through the 61.8% retracement at 83.12. Interim support now 82.61 with subsequent topside resistance targets eyed at 83.61/70 and the 38.2% retracement at 84.25- and area of interest for possible near-term exhaustion / short entries. Broader bullish invalidation steady at 81.88/93.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Find yourself getting trigger shy or missing opportunities? Learn how to build Confidence in Your Trading

-Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex or contact him at mboutros@dailyfx.com