Non-Farm payrolls are on tap this Friday and the USD crosses are in play heading into the release. Specifically, we’ll be eyeing opportunities in AUDUSD, USDCAD & NZDUSD as we search for a near-term high in U.S. Dollar Index- keep in mind seasonality’s turn rather bearish for the greenback into the July open. With that said, here are the trades I’ll be following into the release and setup’s we’re currently tracking on SB Trade Desk.

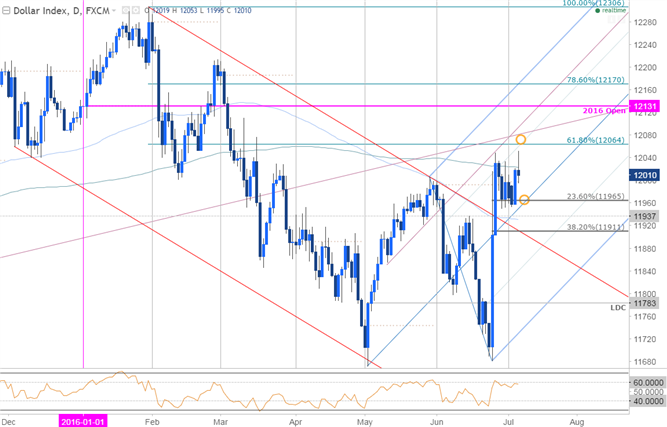

USDOLLAR Daily

USDOLLAR- Price action remains range-bound ahead of tomorrow’s ADP report. Bottom line I would be looking to sell strength towards confluence resistance at the highlighted region just above the 61.8% retracement at 12064 with a break sub 11965 needed to suggest a more significant reversal is underway.

AUDUSD- I’ve been on the long-side of AUDUSD since last night after the pair rebounded off confluence support around 7424. Highlighted this setup in today’s scalp report- Broadly looking to remain constructive while above the weekly open. Initial targets to keep an eye on are 7571 & 7644.

USDCAD- We alerted clients last night of near-term exhaustion in the USDCAD with the pullback now approaching confluence support around 1.2944. The outlook remains constructive while above the weekly open / 61.8& retracement at 1.2915/17targeting basic trendline resistance extending off the May high. Review latest USDCAD update

NZDUSD- Kiwi has been on fritz lately but our general focus is lower in the pair while below 7200. Although dollar tendencies are weaker into the monthly open, long-term technical resistance leaves the rally vulnerable below the figure and we’ll be looking for a break below 7014 (Brexit hourly high-volume level) in order to safe-guard against selling into constructive price action.

Continue tracking all these setup and more throughout the week- Subscribe to SB Trade Desk and take advantage of the DailyFX New Subscriber Discount!

Looking for more trade ideas? Review DailyFX’s 2016 3Q Projections

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or ClickHere to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)