We’ll want to stay nimble & lower leverage heading into Non-Farm Payrolls and the start of April trade tomorrow. That’s said, we’ll be closely eyeing price action in the Dow Jones FXCM Dollar index for cues on the dollar crosses.

USDOLLAR- The index is eyeing near-term support at the October lows and the immediate short-bias is at risk heading into tomorrow’s U.S. labor report. We’ll be looking for a rally heading into the April open to offer more favorable short entries. Review USDOLLAR Scalp Targets

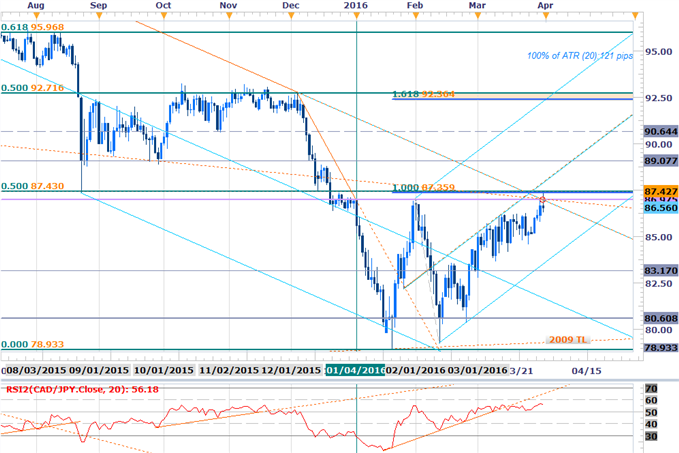

CADJPY Daily

CADJPY- We’ve been tracking this setup on SB Trade Desk & the focus is on a critical resistance confluence tested today at 84.36/43. This level is defined by the 100% extension off the yearly low & the 50% retracement 2009 rally. Also note that a basic trendline support extending off the October lows converges on this region. Failure to breach today and a close below the yearly open at 86.98 shifts the immediate focus lower. Intraday trading levels for this setup are posted on SB.

Continue tracking this setup and more throughout the week- Subscribe to SB Trade Desk and take advantage of the DailyFX New Subscriber Discount!

Looking for more trade ideas? Review DailyFX’s Top Trading Opportunity of 2016

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)