EUR/AUD price, news and analysis:

- The outlook for EUR/AUD is bearish as commodity currencies such as the Australian Dollar benefit from the current global economic expansion after the contraction caused by the coronavirus pandemic.

- Australia produces many of the raw materials like iron ore, copper and aluminum that will be in demand as economic growth picks up, and that should benefit AUD against currencies such as EUR, CHF and JPY.

EUR/AUD outlook bearish

As the global economy expands after the savage downturn caused by the Covid-19 pandemic, commodity currencies like the Australian Dollar are well placed to advance. In particular, the outlook for EUR/AUD is bearish as the pair has actually been strengthening since late February despite all the signs of an economic recovery.

As the chart below shows, EUR/AUD hit a recent low at 1.5253 on February 25 and has since climbed to just over 1.55. While there is trendline support currently around 1.5360, it would be no surprise if that level were challenged and eventually breached.

EUR/AUD Price Chart, Daily Timeframe (October 1, 2020 – May 5, 2021)

Source: IG (You can click on any of the charts for larger images)

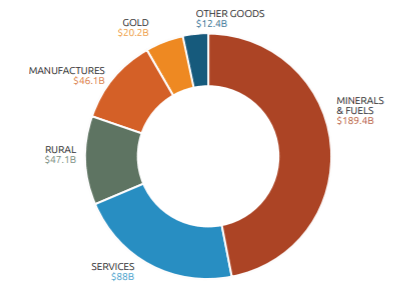

Australia is a major producer of raw materials such as iron ore, copper and aluminum that should all be in demand from industry as it picks up after the downturn. In fact, minerals and fuels accounted for 47% of its total exports according to the latest data.

Source: Australian Department of Foreign Affairs and Trade (data in A$)

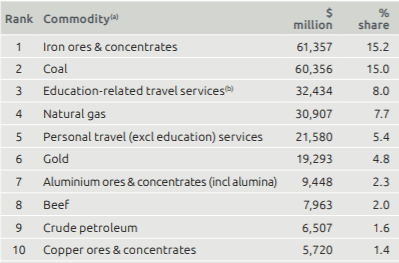

Among these, iron ore is Australia’s major export, followed by natural gas and gold.

Source: DFAT (data in A$)

Taking iron ore as an example, the price has advanced by 94% in the past 15 months, reaching record highs as supply has been unable to keep pace with demand from China, where steel output has grown by 30% over the past five years.

Iron Ore Price Chart, Daily Timeframe (January 8, 2020 – May 5, 2021)

Source: IG

Similarly, the price of copper has more than doubled since its low back in March 2020 so it is remarkable that the Australian Dollar has not benefited more than it has. A drop in EUR/AUD would therefore be no surprise, prompting this bearish call on the cross and, by extension, strength in other commodity currencies such as CAD and NZD as well.

--- Written by Martin Essex, Analyst

Feel free to contact me on Twitter @MartinSEssex