USD/SGD STRATEGY: BEARISH

- Singapore Dollar strengthened following the MAS’s surprise move to tighten policy

- The central bank foresees inflationary pressures and is ready to act promptly, paving the way for SGD to appreciate further

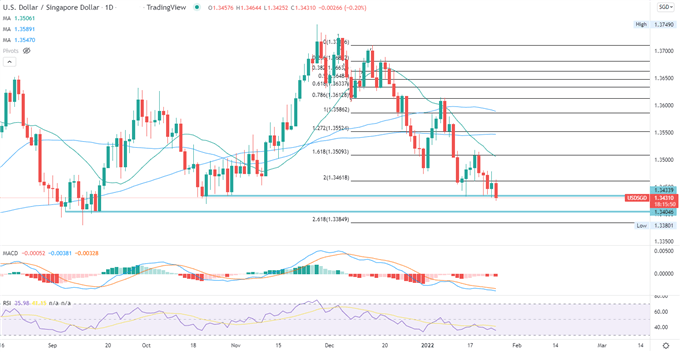

- USD/SGD is eyeing 1.3434 for immediate support. The overall trend remains bearish-biased

The Singapore Dollar strengthened against its major trading peers on Monday after the Monetary Authority of Singapore (MAS) surprised the market with a hawkish move. The central bank decided to ‘slightly raise the rate of appreciation’ of the Singapore Dollar against a basket of currencies in an effort to rein in inflation. This means that MAS will allow the SGD to appreciate against its peers in the months ahead to counter rising cost levels.

The USD/SGD currency pair fell to 1.3438 in responding, marking the lowest level seen since October 2021. It may extend its downward trajectory as the MAS signals its willingness and ability to act preemptively if inflation becomes entrenched and starts to hurt economic growth. Officials usually review and set monetary policy twice a year, in April and October respectively. This off-cycle move underscores the urgency to act as the central bank foresee inflationary risks in the months to come, which may add into wage pressure and weigh on domestic consumption.

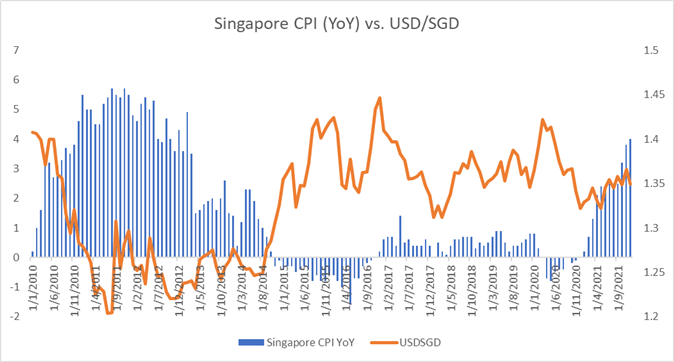

The island country relies heavily on imports, so rising price levels around the globe are having a significant impact on the country’s domestic economy and household spending. Singapore’s CPI hit 4% in December, the highest level seen in 8 years. At the same time, US CPI hit a four-decade high of 7%, spurring concerns that the Fed may need to tighten sooner and faster to contain rising price levels.

Markets have now fully priced in four rate hikes in 2022 and balance sheet reduction at some time later this year. Wednesday’s FOMC meeting and press conference will be in the spotlight as traders scrutinize the timeline for simulation withdrawal. A more hawkish-biased tone from the Fed may lead USD/SGD to recover some recent losses.

Singapore CPI vs USD/SGD

Source: Bloomberg, DailyFX

USD/SGD TECHNICAL ANALYSIS

USD/SGD appears to be in a bearish setup since December, falling over 2% from its recent high. Prices formed consecutive lower highs and lower lows, underscoring a bearish trend. An immediate support level can be found at around 1.3434, followed by 1.3405. Breaching below 1.3405 may intensify selling pressure and open the door for further losses. The RSI and MACD indicators are both sloping downwards, suggesting that sellers are taking control.

GBP/JPY daily chart created with TradingView

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter