Check out the brand new Q1 FX forecast guides

USDJPY BEARISH BELOW 110.00-45

- Risks: Equity Markets Continue to Rise, Global Data Picks up Notably

Dovish Fed, Limited Upside for Risk Markets to Spark Bid in Safe Haven JPY

Risks to the global economic outlook are deteriorating, which in turn has led to central banks altering their bias with regard to monetary policy, most notably the Federal Reserve provided a dovish pivot last week. As such, with the support from the Fed unwinding for the USD, risks are tilting to the downside.

The typically safe-haven JPY has weakened in light of a bounce back in equity markets. Despite the fact that this boost in equity markets has predominantly been based on a dovish Fed that has grown concerned over the economic outlook. Alongside this, the bid in equity markets has also come at time when market volumes have been somewhat lighter.

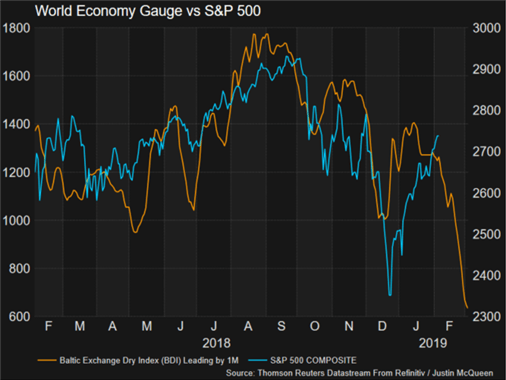

As such, further upside for risk markets (equities) may be somewhat limited going forward, which has also been signalled by the Baltic Dry Index (typically seen as a gauge for the world economy). Consequently, as fears over a global slowdown rise, pushing risk markets lower, the JPY may see safe-haven flows begin to support.

JPY Repatriation at Fiscal Year End

Elsewhere, seasonal factors may begin to support JPY, which tends to benefit from repatriation flows ahead of the Japanese fiscal year end. On average, over the past 5 years, USDJPY has dropped 3.76% in Q1, making it the worst performing quarter. Repatriation flows include profits from overseas units as well as dividend and interest income, meaning notable JPY buying. Given that USDJPY has typically moved over 3.7% in Q1, this could see USDJPY test the mid 105s.

USDJPY Technical Levels

Resistance 1: 110.00

Resistance 2: 110.15

Resistance 3: 111.25

Support 1: 109.27

Support 2: 108.50

Support 3: 107:90

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX