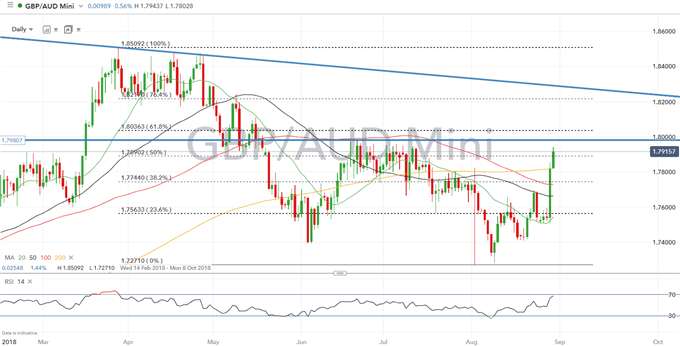

GBPAUD Trading Strategy: Long at 1.7980, target 1.82, stop 1.7740

- Trade Risk: Pullback in the recent rally, signs that a US-Chinese trade agreement is reached

See our Q3 FX forecast to learn what will drive major currencies throughout the quarter.

GBPAUD Fundamental Overview

Much of the negative newsflow regarding Brexit has been priced in and given the recent price action the Pound is seemingly more sensitive to positive headlines. This has been evidence by comments made by EU Chief Negotiator Barnier, who hinted that the EU would be prepared to offer a partnership with the UK after Brexit. In light of these comments, which had caught the markets off guard, risk premium related to no-deal Brexit has been slightly re-priced. As such, this sign that the EU is willing to budge from its negotiating position alongside the large speculative short positioning has reduced the attractiveness of chasing GBP lower on no-deal Brexit risks. If an agreement is reached between the UK and EU between October and November, expect a large corrective move higher.

Short term fundamentals have deteriorated over the past couple of weeks, namely from the turbelenece in Australian Politics with Malcom Turnbull replaced by Scott Morrison as PM. Since 2010, there has been a strong track record of selling the Aussie in the short term after a new PM has been found in an internal battle. Elsewhere, actions taken by Austrlia’s second largest lender, Westpac, in which the bank raised home loan rates in response to increased wholesale funding costs has increased the likelihood that the rest of the “big 4” banks will follow. This in turn, increases tightening in financial conditions and therefore reduces the pressure for the RBA raise interest rates.

Trade wars continues to dampen risk sentiment with the Trump administration looking to press ahead in imposing $200bln worth of tariffs on Chinese goods by next week. The Australian Dollar which is seen as a proxy for Chinese economic performance is thus likely to remain pressured in the near term.

GBPAUD Technical Overview

Resistance 1: 1.80 (Psychological)

Resistance 2: 1.8035 (Fib level)

Resistance 3: 1.8110 (May 16th High)

Support 1: 1.7820 (200DMA)

Support 2: 1.7780 (August 2nd High)

Support 3: 1.7745 (Fib level)

GBPAUD PRICE CHART: Daily Time Frame (February-August 2018)

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX