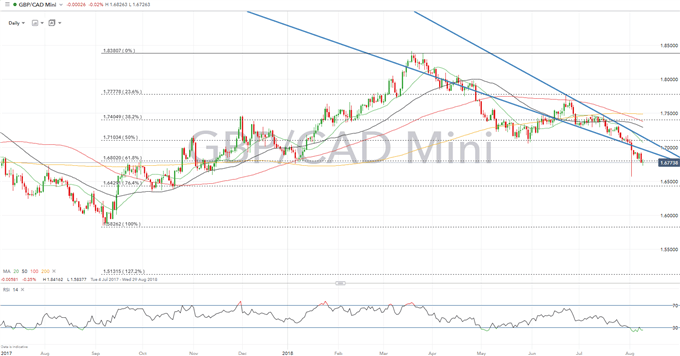

GBPCAD Trading Strategy: Short at 1.6820 to , target 1.6430, stop loss 1.7060

- Trade Risk: NAFTA presents largest risk, alongside a relief rally in GBP.

See our Q3 FX forecast to learn what will drive major currencies throughout the quarter.

GBPCAD Fundamental Overview

GBP

The poor performance for the Pound has shown no signs of abating. After last weeks rate hike from the BoE failed to inspire any real support for GBP, it is clear that Brexit remains the key driver for the Pound. Uncertainty regarding Brexit has increased with the UK Trade Minister stating that a “no deal Brexit is the most likely scenario, while BoE Governor Carney has noted that the chance of a “no deal” is uncomfortably high. As such, markets have repriced the possibility of a “no deal” Brexit, prompting the Pound to fall to its lowest level since August 2017, while option markets have increased their demand for protection against deeper GBPUSD losses as risk reversals fall to levels seen in early 2017.

Elsewhere, in regard to data performance, the underlying economy continues to remain relatively weak, with growth subdued, wage growth failing to show any material signs of life, while inflation has eased slightly in recent months.

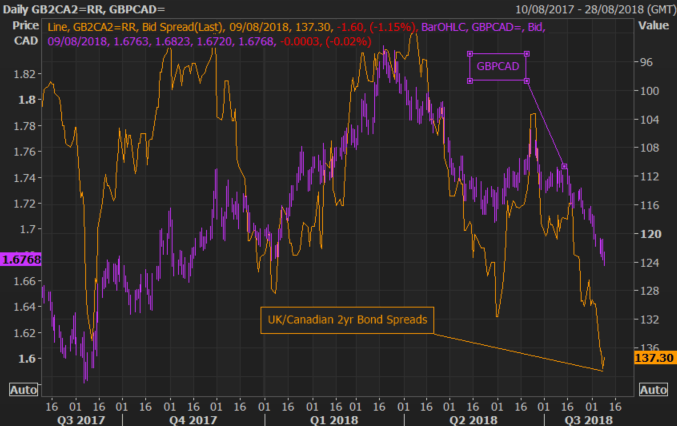

In recent weeks the Canadian Dollar has continued to enjoy a flurry of strong data points. The latest GDP figures had surpassed expectations, showing the fastest growth spurt in a year, led by oil prices, while inflation remains above the BoC’s target and is expected to push higher, consequently prompting calls for the central bank to raise rates. Rate differentials continue to move in favour of CAD buying against GBP with OIS markets pricing in 3 rate hikes by the time the BoE hike again. This has been reflected in 2yr UK/Canadian Bond spreads at the widest since September 2017. Consequently, implying that GBPCAD is vulnerable to further losses with the bearish momentum very much intact.

Risks for the Canadian Dollar is of course NAFTA, however, with the US and Mexico making progress this has subsequently lifted optimism that a deal could be on the horizon.

UK/Canadian 2yr Bond Spreads

GBPCAD Technical Overview

Resistance 1: 1.6800 (61.8% Fib Level)

Resistance 2: 1.6930 (Weekly Highs)

Resistance 3: 1.7050 (Psychological Level)

Support 1: 1.6750

Support 2: 1.6590 (November 2017 low)

Support 3: 1.6500 (Psychological level)

GBPCAD PRICE CHART: Daily Time Frame (July 4th-28th)

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX