USD/JPY Trades to its lowest level in four months touching 110, which is our first target zone. Our Elliott Wave analysis hints at additional losses towards 107.

USD/JPY Elliott Wave Analysis Talking Points:

- USD/JPY reaches 110 as we take partial profits on our short trade activated January 9

- Our secondary take profit level is 108 with the risk level moved to 111.50

- Our Elliott Wave analysis suggests we are in a complex ‘B’ wave that may break 107.31

On January 3, 2018, we wrote how the price action for USD/JPY was showing symptoms of breaking its trading range and may trade lower. As a result, we established an analyst pick for a short break out trade near 111.98 that was activated on January 9.

Price was successful on falling to our first target level of 110 so half of the position was closed out for 198 pips of profit today. The remainder of the position has a profit target of 108 and risk level of 111.50. USD/JPY may fall further but since we think this is a large ‘B’ wave, we do not want to get too greedy.

USD/JPY Sentiment Analysis

The sentiment reading for USD/JPY has increased from +1.5 to +1.8. Sentiment is a good contrarian signal in that if most traders are long, we will look for short opportunities. Since the reading has increased, this means the pool of net longer traders has grown becoming a stronger signal for short opportunities. In the context of the USD/JPY trade idea, sentiment suggests the downtrend may not be over.

USDJPY Elliott Wave Chart Analysis

USD/JPY has descended to meet the lower portion of the price channel. The pair might find some support nearby and bounce which is why we wanted to capture some profits first. Our Elliott Wave analysis suggests USD/JPY may break to below 107.31, but as a trader, we need to be mindful of our risk versus our reward. We will be happy exiting the trade near 108 in case a larger rally ensues.

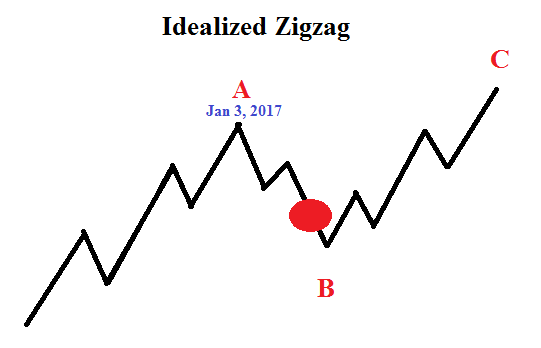

The Elliott Wave model we are following illustrates we are in the middle of a zigzag pattern. Once this washout completes, likely below 107.31, the stage may be set for a rally in the ‘C’ wave of the zigzag.

Elliott Wave Theory FAQs

What is the Elliott Wave Theory?

Elliott Wave Theory is a forex trading stud that identifies the highs and lows of price movements on charts via wave patterns. Traders often analyze the 5-wave impulse sequence and 3-wave corrective sequence to help them trade forex strategically. We cover these wave sequences in our beginners and advanced Elliott Wave trading guides.

Why should traders be mindful of the risk to reward ratio?

At DailyFX, we studied millions of live trades and found one strong factor influencing the profitability of the trader, the risk to reward ratio. Our Traits of Successful Traders research found that traders who risked less than their profit target tended to have more consistent results because they did not need to be right on every single trade. This alleviates a lot of pressure on the trader so when you do capture that strong trend, that one winning trade can cover multiple losing trades bringing more stability to your results.

New to FX trading? We created this guide just for you.

---Written by Jeremy Wagner, CEWA-M

Jeremy Wagner is a Certified Elliott Wave Analyst with a Master’s designation. Jeremy provides Elliott Wave analysis on key markets as well as Elliott Wave educational resources. Read more of Jeremy’s Elliott Wave reports via his bio page.

USD/JPY and as well as EUR/JPY, GBP/JPY, and AUD/JPY were markets discussed in Jeremy’s January 3 webinar forecasting 2018 trends. Watch a recording by registering here.

Discuss this market with Jeremy in Monday’s US Opening Bell webinar.

Follow on twitter @JWagnerFXTrader .

Join Jeremy’s distribution list.