- For trading ideas, please check out our Trading Guides. And if you’re looking for something more interactive in nature, please check out our DailyFX Live webinars.

To receive James Stanley’s Analysis directly via email, please sign up here.

Euro Strength, U.S. Dollar Avoidance

Euro strength has been a dominant theme across Forex markets for much of the past year, and naturally much of the focus of that attention has been drawn to the most popular currency pair in the world of EUR/USD. But – that theme has some issues at the moment, primarily in the fact that a really strong Euro is paired up with an extremely weak U.S. Dollar, and this presents the challenging prospect of trading two rather volatile themes simultaneously.

Instead, traders can look to split those themes by focusing each of the Euro or U.S. Dollar in other venues, and we discussed the prospect of EUR/JPY earlier this morning as well as yesterday in the technical article, EUR/JPY Runs into Fibonacci Support at Prior Triple Top.

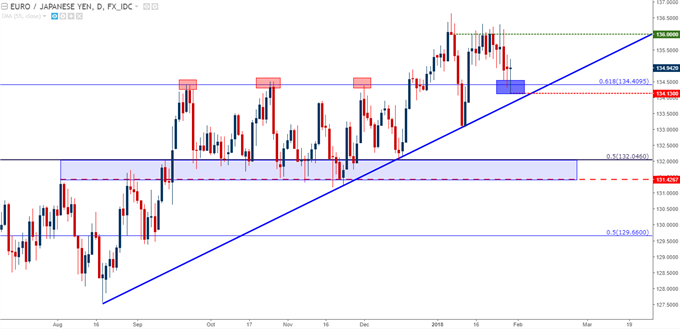

The price of 134.41 has been a key level in EUR/JPY for the past four months. This is the 61.8% retracement of the 2014-2016 major move in the pair, and when price action ran into this area in early September, resistance set-in as prices pulled lower. This wasn’t the last time that 131.41 would prove resistant, as recurrent attempts to overtake this level in October and again in early-December both failed. It wasn’t until year-end flows began to drive the pair higher that this resistance was able to finally give way, and now we have the possible scenario of prior resistance showing up as fresh support.

Stops can be set below 134.10 to get below today’s low, allowing for initial profit targets at the short-term resistance zone around 136.00. Optionally, the exit can be scaled-out, with initial targets and a break-even stop move at 136.00, followed by an open target on the remainder of the lot, looking for a bullish breakout above this year’s high. Areas of interest for secondary targets can be investigated at 137.50, 138.20 and then the psychological level at 140.00.

EUR/JPY Daily Chart: Will Support Hold at Prior Resistance?

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on Euro, GBP or the U.S. Dollar? Our DailyFX Forecasts for Q1 have a section for each major currency, and we also offer a plethora of resources on our EUR/USD, USD/JPY and U.S. Dollar pages. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

--- Written by James Stanley, Strategist for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX