- For trading ideas, please check out our Trading Guides. And if you’re looking for something more interactive in nature, please check out our DailyFX Live webinars.

To receive James Stanley’s Analysis directly via email, please sign up here.

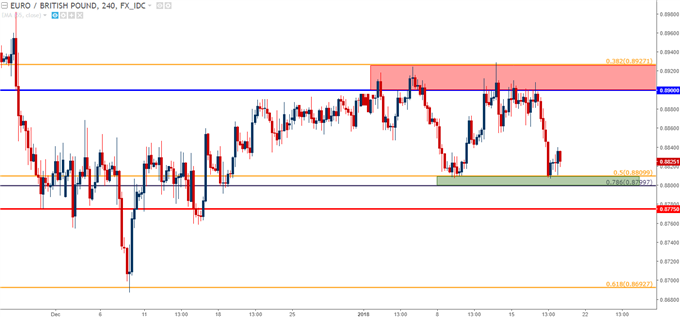

Bullish EUR/GBP Off of Range Support

Both the Euro and British Pound have been rather strong this year against US and Japanese counter-parts. This leaves bullish trends in many of the more popular pairings available to traders, and for those looking for ways of taking a short-side stance against the British Pound, it would appear that few attractive options are available.

One area of interest for such a drive could be the recent range in EUR/GBP. After prices in the pair spent the bulk of last summer trending-higher, a pullback has developed with support continuing to show around the 50% retracement of that move. That support level aligns with another Fibonacci level, taken from the longer-term bullish trend that started in 2015 and set a fresh eight-year high just last year. The 23.6% retracement of that move comes-in at .8800, and given its close proximity to the 50% retracement of the shorter-term move at .8810, this would offer traders a confluent area of support to work with.

Stops can be set below .8775 to give some room for that support zone, and this would enable a better than 1-to-1 risk-reward ratio with initial profit targets on a re-test of .8900, at which point stops can be adjusted up to break-even. For those that’d like to look for a break of the range, secondary profit targets could be set to .8925, just inside of the 38.2% Fibonacci retracement that helped to set resistance last week, followed by the psychological level of .9000, which gave multiple iterations of resistance throughout Q4 of last year.

EUR/GBP Four-Hour: Price Action Testing Range Support

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on Euro, GBP or the U.S. Dollar? Our DailyFX Forecasts for Q1 have a section for each major currency, and we also offer a plethora of resources on our EUR/USD, GBP/USD and U.S. Dollar pages. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

--- Written by James Stanley, Strategist for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX