- For trading ideas, please check out our Trading Guides. And if you’re looking for something more interactive in nature, please check out our DailyFX Live webinars.

To receive James Stanley’s Analysis directly via email, please sign up here.

AUD/NZD has been on a rather brisk run of recent, and the pair is currently seeing some element of support at a trend-line that started around two months ago. And while this can open the door to topside setups in the cross-pair, this can also be utilized to take a hedged stance around the U.S. Dollar, looking to sell New Zealand Dollars and buy Australian Dollars against USD. The goal of such a strategy is optimized risk-reward ratios, so that even a 50/50 can lead to a profitable set of trades.

AUD/NZD Four-Hour: Bullish Trend-Line Inflection Holds the Lows

Chart prepared by James Stanley

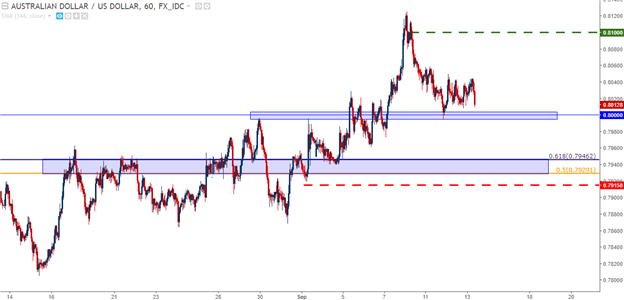

Long AUD/USD for USD-Weakness Continuation

AUD/USD continues to flirt with the psychologically important .8000-level, and earlier this week brought upon a support inflection that highlights how markets may be getting more comfortable with .8000+ AUD/USD spot rates. Nonetheless, I want to give a little bit of room to this position so that another re-test around .8000 doesn’t wash me out. Just below current support is a confluent zone that runs from .7929-.7946, and this could be an ideal washout level as prices below this zone indicate that the bullish AUD/USD position is not ready for prime time.

A stop at .7915 gives some distance below this zone while taking on ~100 pips of risk, and this can open the door to a break-even stop inside of the prior high at .8100, with an initial profit target at .8160. Additional targets can be set to .8200 and .8250.

AUD/USD Hourly

Chart prepared by James Stanley

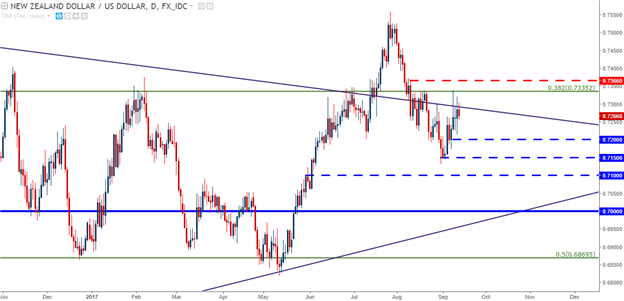

Short NZD/USD for USD-Strength Scenarios

While the U.S. Dollar has continued to show weakness, the New Zealand Dollar has been even weaker since late-July. The previous high-flying trend in NZD/USD continues to hit the skids, and we’re currently seeing resistance at an interesting zone in the pair. The price of .7335 is the 38.2% retracement of the pair’s 2009-2011 major move, and this level has shown numerous instance of support/resistance in the recent past.

This can open the door for a similar 100-pip stop as the above AUD/USD position at .7366, along with a break-even stop at .7200. The first target at .7150 can allow for a deeper break-even stop move, with additional profit targets set to .7100 and then the major psychological level of .7000.

NZD/USD Daily

Chart prepared by James Stanley

--- Written by James Stanley, Strategist for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX