EURUSD eyes the September high (1.1110) as the European Central Bank (ECB) pushes for fiscal support, but the advance from the start of the month appears to be sputtering as the exchange rate fails to extend the series of higher highs and lows from the previous week.

The account of the ECB’s September meeting suggest the central bank will revert to a wait-and-see approach at the next meeting on October 24 as the statement reveals a range of different views within the Governing Council.

In turn, ECB officials may continue to emphasize that “governments with fiscal space should act in an effective and timely manner” as the central bank pushes monetary policy into uncharted territory.

However, the divide at the ECB undermines the central bank’s ability to achieve its one and only mandate for price stability as the Governing Council relies on non-standard measures to combat the downside risks surrounding the monetary union.

Nevertheless, it seems as though the ECB will retain a dovish forward guidance as officials reiterate that the central bank “continues to stand ready to adjust all of its instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner.”

As a result, EUR/USD may face a more bearish fate over the coming days as the ECB prepares to reestablish its asset-purchase program in November, while the Federal Reserve appears to be approaching the end of its rate easing cycle.

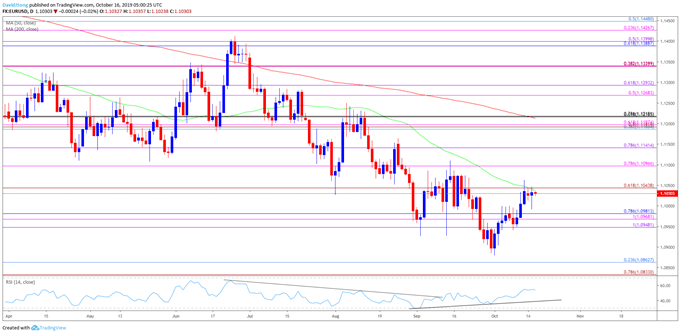

EUR/USD Rate Daily Chart

Source: Trading View

Keep in mind, the broader outlook for EUR/USD remains tilted to the downside as the exchange rate clears the May-low (1.1107) following the Federal Reserve rate cut in July, with Euro Dollar trading to a fresh yearly-low (1.0879) in October.

However, recent price action warns of a larger correction as EUR/USD breaks out of the monthly opening range, with the close above the Fibonacci overlap around 1.0950 (100% expansion) to 1.0980 (78.6% retracement) raising the risk for a run at the September-high (1.1110).

With that said, the lack on momentum to close above the 1.1040 (61.8% expansion) region may bring the downside targets back into focus as EUR/USD fails to extend the series of higher highs and lows from the previous week.

Failure to hold above the overlap around 1.0950 (100% expansion) to 1.0980 (78.6% retracement) may bring the October-low (1.0879) on the radar, with the next area of interest coming in around 1.0830 (78.6% expansion) to 1.0860 (23.6% retracement).

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

Additional Trading Resources

For more in-depth analysis, check out the 4Q 2019 Forecast for the Euro

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.