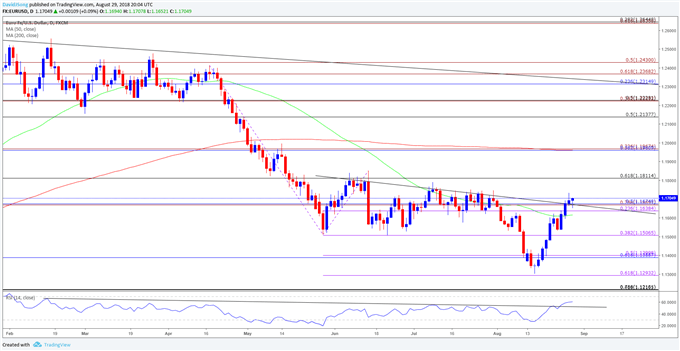

The near-term rebound in EUR/USD appears to be losing steam as it snaps the series of higher highs & lows from the previous week, but a broader shift in market behavior appears to be taking shape as both price and the Relative Strength Index (RSI) threaten the bearish trends from earlier this year.

Even though the Federal Open Market Committee (FOMC) is widely expected to raise the benchmark interest rate in September, the central bank appears to have little to no interest in speeding up the normalization process as Chairman Jerome Powell talks down the risk for above-target inflation.

In turn, the FOMC may opt for a dovish rate-hike on September 26 as ‘participants observed that if a large-scale and prolonged dispute over trade policies developed, there would likely be adverse effects on business sentiment, investment spending, and employment,’ and the U.S. dollar my exhibit a more bearish behavior over the remains of the year if Chairman Powell & Co. continue to project a neutral Fed Funds rate of 2.75% to 3.00%.

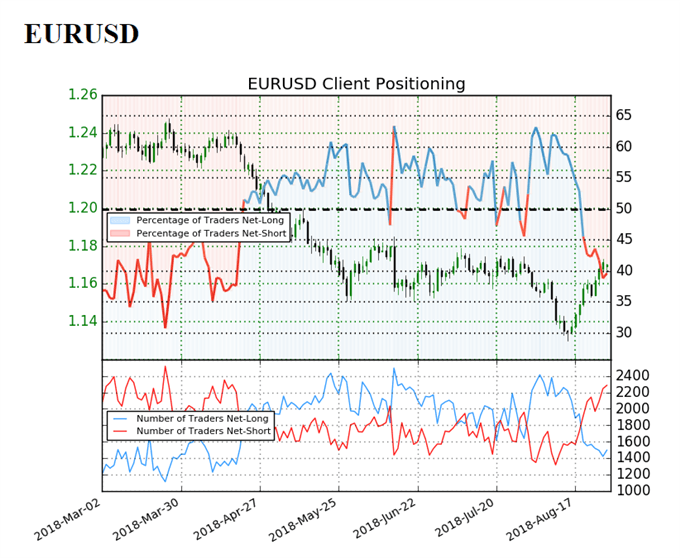

At the same time, the IG Client Sentiment Report shows 39.6% of traders are now net-long EUR/USD, with the ratio of traders short to long at 1.52 to 1 even though the exchange rate breaks the monthly opening range.In fact, traders have been net-short since August 21 when EUR/USD traded near 1.1575. The number of traders net-long is 1.7% higher than yesterday and 5.6% lower from last week, while the number of traders net-short is 2.3% higher than yesterday and 8.8% higher from last week.

The recent shift in retail positioning offers a contrarian view to crowd sentiment as there appears to be a more dynamic shift in trader behavior, with the topside targets still on the radar for EURUSD as bothprice and Relative Strength Index (RSI) threaten the bearish trends from earlier this year. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

EUR/USD Daily Chart

The advance from the 2018-low (1.1301) may continue to gather pace as EUR/USDbreaks the monthly opening range, with a close above the 1.1640 (23.6% expansion) to 1.1680 (50% retracement) region raise the risk for a move back towards 1.1810 (61.8% retracement), which largely lines up with the July-high (1.1791).

For more in-depth analysis, check out the Q3 Forecast for the Euro

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.