EUR/USD extends the rebound from the 2018-low (1.1301) as U.S. President Donald Trump comments on Fed policy, and recent price action raises the risk for a larger correction as the exchange rate extends the series of higher highs & lows from earlier this month.

However, the Federal Open Market Committee (FOMC) Minutes appear to have tamed the advance in EUR/USD as the central bank strikes a hawkish tone, and it seems as though Chairman Jerome Powell & Co. will stay on course to implement higher borrowing-costs as ‘many participants suggested that if incoming data continued to support their current economic outlook, it would likely soon be appropriate to take another step in removing policy accommodation.’

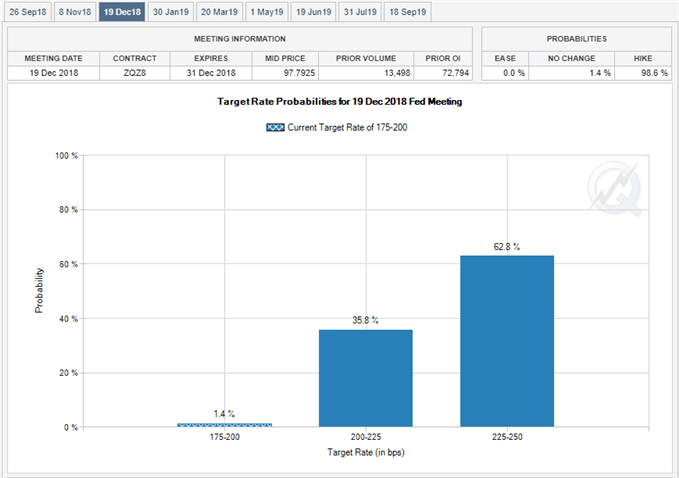

With Fed Fund Futures still reflecting expectations for four rate-hikes in 2018, comments coming out of the Economic Symposium in Jackson Hole, Wyoming, may influence the near-term outlook for EUR/USD as Chairman Powell is slated to speak at the event, and it seems as though the central bank head will continue to prepare U.S. households and businesses for higher interest rates as ‘members expected that further gradual increases in the target range for the federal funds rate would be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective over the medium term.’

With that said, a batch of hawkish Fed rhetoric may continue to curb the recent strength in EUR/USD, but recent price action raises the risk for a larger correction in the exchange rate as it continues to carve a series of higher highs & lows. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

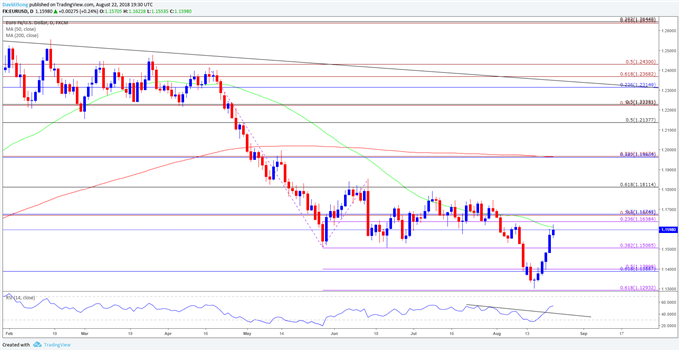

EUR/USD Daily Chart

The rebound from the 2018-low (1.1301) may gather pace as EUR/USD extends the bullish sequence from the previous week, while the Relative Strength Index (RSI) bounces back from oversold territory and snaps the bearish formation carried over from July. The close above the former-support zone around 1.1510 (38.2% expansion) opens up the Fibonacci overlap around 1.1640 (23.6% expansion) to 1.1680 (50% retracement), with the next region of interest coming in around 1.1810 (61.8% retracement).

However, failure to break/close above the 1.1640 (23.6% expansion) to 1.1680 (50% retracement) region may give way to range-bound conditions, with support coming in around 1.1290 (61.8% expansion).

For more in-depth analysis, check out the Q3 Forecast for the Euro

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.