EUR/USD tumbles to a fresh 2018-low (1.1432) after snapping the series of higher highs & lows from earlier this week, with the exchange rate at risk of exhibiting a more bearish behavior over the coming days as the

Concerns surrounding the European banking system appears to be rattling the Euro amid the region’s exposure to Turkey, and the geopolitical risks surrounding the euro-area may encourage the European Central Bank (ECB) to further support the monetary union as ‘uncertainties related to global factors, including the threat of increased protectionism, have become more prominent.’

Even though the ECB pledges to wind down the quantitative easing (QE) program over the coming months, the Governing Council may merely attempt to buy more time at the next meeting on September 13, and President Mario Draghi & Co. may continue to endorse a dovish forward-guidance as ‘significant monetary policy stimulus is still needed to support the further build-up of domestic price pressures and headline inflation developments over the medium term.’

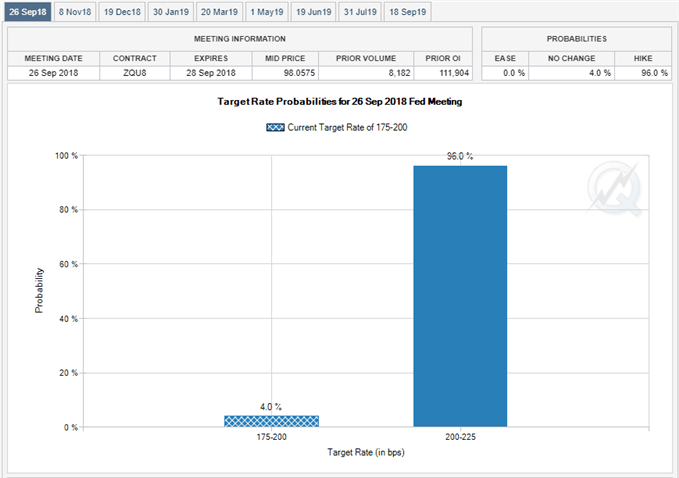

In contrast, the Federal Open Market Committee (FOMC) is widely expected to deliver a 25bp rate-hike next month, with Fed Fund Futures pricing a greater than 90% probability for n adjustment on September 26, and Chairman Jerome Powell & Co. may continue to prepare U.S. households and businesses for higher borrowing-costs as ‘the Committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective over the medium term.’

With that said, the diverging paths for monetary policy keeps the broader outlook tilted to the downside, with EUR/USD now at risk of extending the decline from earlier this year as it finally snaps the range-bound price action carried over from June. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

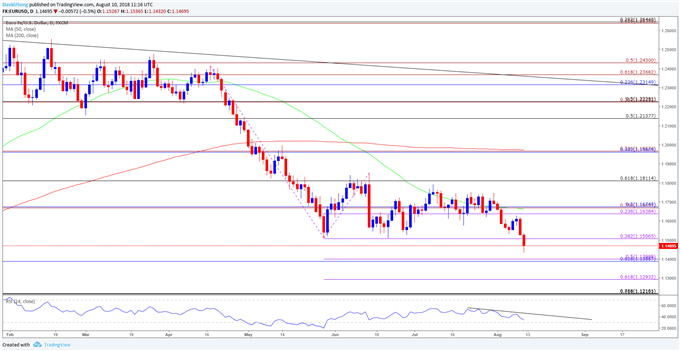

EUR/USD Daily Chart

The break of the June-low (1.1508) brings the downside targets back on the radar, with the move below the 1.1510 (38.2% expansion) region raising the risk for a run at the Fibonacci overlap around 1.1390 (61.8% retracement) to 1.1400 (50% expansion). A break/close below the stated region opens up the next downside region of interest around 1.1290 (61.8% expansion) followed by the 1.1220 (78.6% retracement) area.

For more in-depth analysis, check out the Q3 Forecast for the Euro

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.