EUR/USD appears to making another run at the June-high (1.1852) as it snaps the string of lower highs & lows from the previous week, but fresh comments from Federal Reserve Chairman Jerome Powell may tame the recent rebound in the euro-dollar exchange rate should the central bank head strike a hawkish tone in front of Congress.

Chairman Powell is likely to reiterate that the U.S. economy is in a ‘good place’ as the Federal Open Market Committee (FOMC) embarks on its hiking-cycle, and the central bank head may prepare U.S. lawmakers for a less accommodative stance as ‘gradually returning interest rates to a more normal level as the economy strengthens is the best way the Fed can help sustain an environment in which American households and businesses can thrive.’

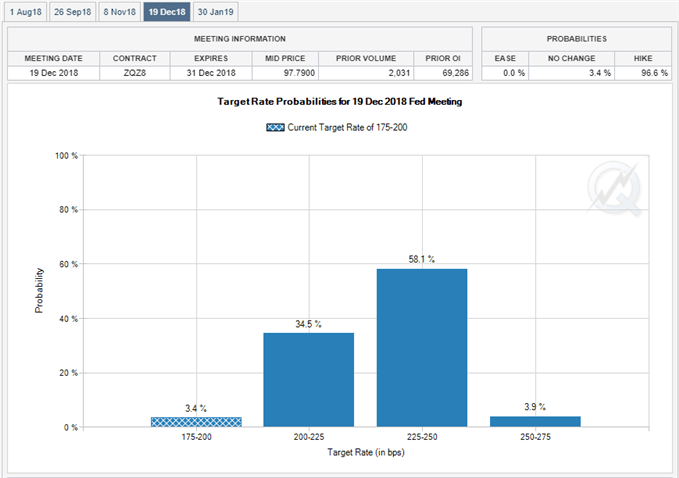

In turn, a batch of hawkish comments may sway the near-term outlook for the EUR/USD, with the dollar at risk of exhibiting a more bullish behavior as Fed Fund Futures now reflect growing bets for four rate-hikes in 2018. However, the threat of a trade war with China may push Governor Powell to strike a cautious tone as ‘most participants noted that uncertainty and risks associated with trade policy had intensified and were concerned that such uncertainty and risks eventually could have negative effects on business sentiment and investment spending,’ and a less-hawkish testimony from the central bank head may produce headwinds for the greenback as market participants scale back bets for a more aggressive hiking-cycle. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

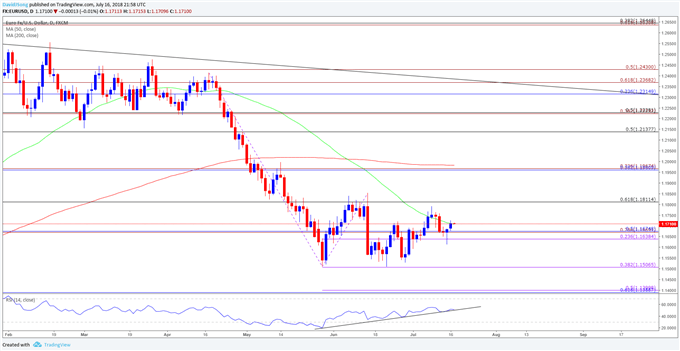

EUR/USD Daily Chart

EUR/USD appears to be stuck in a near-term range as the 1.1510 (38.2% expansion) offers support, but recent price action raises the risk for a more meaningful run at the June-high (1.1852) as it snaps the bearish sequence from the previous week. Need a close above the 1.1810 (61.8% retracement) region to favor a larger recovery, with the next area of interest coming in around 1.1960 (38.2% retracement) to 1.1970 (23.6% expansion). Will retain a constructive view for EUR/USD as the Relative Strength Index (RSI) continues to track the upward trend carried over from the previous month, but a break of trendline support may warn of range-bound conditions as the bullish momentum unravels.

For more in-depth analysis, check out the Q3 Forecast for the Euro

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.