Sign Up & Join DailyFX Currency Analyst David Song to Discuss Key FX Themes & Potential Trade Setups.

EUR/USD may continue to retrace the decline from the 2017-high (1.2092) as it bounces back ahead of the August-low (1.1662) and carves a fresh series of higher highs & lows.

Despite the uncertainty posed by Catalan’s push for independence, EUR/USD may exhibit a more bullish behavior ahead of the next European Central Bank (ECB) meeting on October 26 as President Mario Draghi and Co. appear to be on course to alter the monetary policy outlook. The Governing Council may lay out a more detailed exit strategy as central bank officials show a greater willingness to conclude the quantitative easing (QE) program over the coming months, and the broader shift in EUR/USD behavior may continue to unfold over the coming months should the ECB continue to strike an improved outlook for the monetary union.

Keep in mind, it seems as though the Governing Council appears to be in no rush to remove the zero-interest rate policy (ZIRP) as ‘the September 2017 ECB staff projections indicated a somewhat slower path for inflation convergence than the June projections, on account of the stronger euro,’ and the central bank may largely endorse a wait-and-see approach in the first-half of 2018 as ‘a very substantial degree of monetary accommodation was still necessary for inflation pressures to build up.’

EUR/USD Daily Chart

DailyFX 4Q Forecasts Are Now Available

In light of the limited reaction to the Federal Open Market Committee (FOMC) Minutes, EUR/USD may continue to recoup the losses from earlier this month, with the pair at risk of making a run at the 2017-high (1.2092) as it carves a fresh series of higher highs & lows. With that said, a close above the 1.1860 (161.8% expansion) region may spur a move back towards 1.1960 (38.2% retracement), with the next topside hurdle coming in around 1.2130 (50% retracement). Will need to keep a close eye on the Relative Strength Index (RSI) as it approaches trendline resistance, with a break of the bearish formation raising the risk for a further appreciation in EUR/USD.

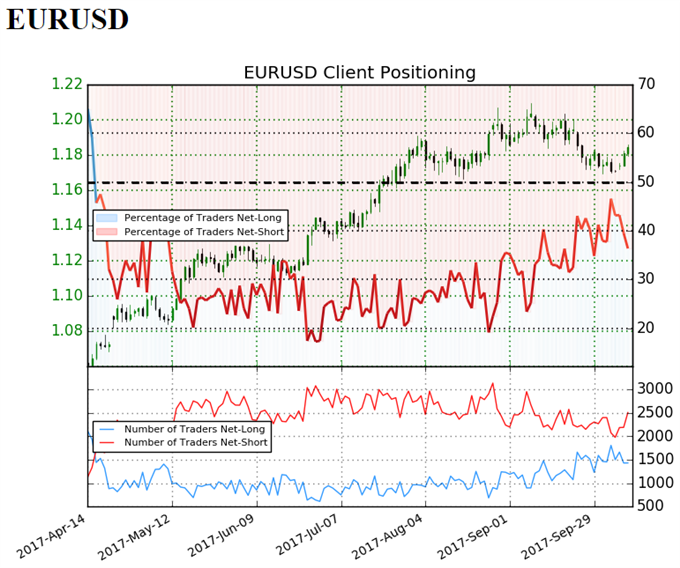

EUR/USD Retail Sentiment

Retail trader data shows 36.4% of traders are net-long EUR/USD with the ratio of traders short to long at 1.75 to 1.

In fact, traders have remained net-short since April 18 when EUR/USD traded near 1.08123; price has moved 9.6% higher since then. The percentage of traders net-long is now its lowest since October 02 when EUR/USD traded near 1.17382. The number of traders net-long is 12.6% lower than yesterday and 8.1% lower from last week, while the number of traders net-short is 16.5% higher than yesterday and 6.7% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

For More Updates, Join DailyFX Currency Analyst David Song for LIVE Analysis!

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.