The European Central Bank’s (ECB) June 8 interest rate decision may fuel the resilience in the EUR/USD exchange rate should President Mario Draghi & Co. adopt an improved tone and gradually alter the outlook for monetary policy.

Even though the ECB is widely expected to preserve the zero-interest rate policy (ZIRP) throughout 2017, the fresh updates coming out of the central bank may heighten the appeal of the single-currency as the risks surrounding the euro-area move ‘towards a more balanced configuration.’ In turn, the ECB may show a greater willingness to gradually wind down its asset-purchase program over the coming months as the quantitative easing (QE) program is set to expire in December.

Keep in mind that tapering the QE program does not signal the start of the normalization process as the ECB appears to be on course to carry the bloated balance sheet into 2018, and President Draghi may is likely to reiterate that ‘a very substantial degree of monetary accommodation is still needed for underlying inflation pressures to build up’ as the central bank struggles to achieve its one and only mandate for price stability.

Nevertheless, a change in the ECB’s forward guidance may continue to sap the bearish sentiment surrounding the single-currency, and a less-dovish policy statement may prop up EUR/USD as market participants scale back bets for additional monetary support.

Have a question about the currency markets? Join a Trading Q&A webinar and ask it live!

EUR/USD Daily

Longer-term outlook for EUR/USD remains constructive as price & the Relative Strength Index (RSI) retain the bullish trends carried over from late-2016, but the pair stands at risk for a near-term correction as it fails to test the November-high (1.1299), while the momentum indicator pulls back ahead of overbought territory.

With that said, the euro-dollar exchange rate may preserve the opening range monthly range going into the ECB meeting, and more of the same from the Governing Council may open up the downside targets as the central bank keeps the door open to further embark on its easing-cycle. First area of interest comes in around 1.1130 (61.8% retracement) to 1.1160 (38.2% expansion) followed by the Fibonacci overlap around 1.0980 (50% retracement) to 1.1020 (50% retracement).

Nevertheless, a less-dovish ECB statement may spark a bullish reaction in EUR/USD, with a break of the November high opening up the next topside hurdle around 1.1330 (23.6% expansion) to 1.1350 (78.6% retracement).

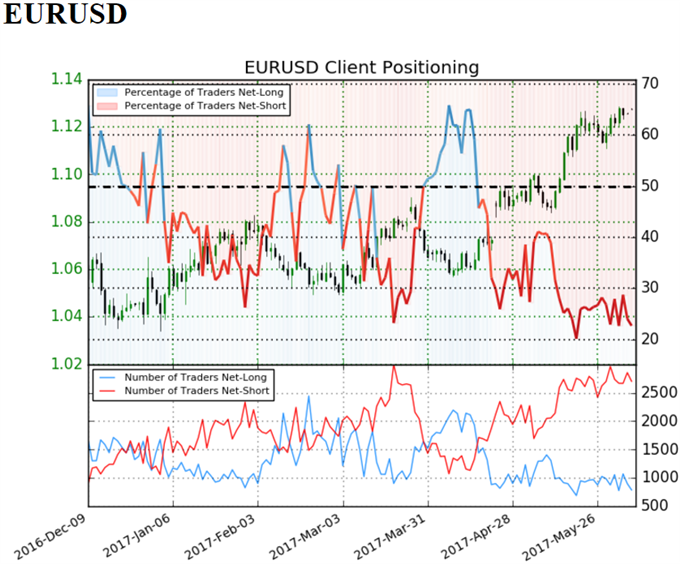

Retail trader data shows 27.8% of traders are net-long EUR/USD with the ratio of traders short to long at 2.6 to 1. In fact, traders have remained net-short since April 18 when EUR/USD traded near 1.06163; price has moved 5.3% higher since then. The number of traders net-long is 1.4% higher than yesterday and 2.4% higher from last week, while the number of traders net-short is 4.4% higher than yesterday and 1.9% higher from last week. For more information on retail sentiment, check out the new gauge developed by DailyFX based on trader positioning.

For More Updates, Join DailyFX Currency Analyst David Song for LIVE Analysis!

If you’re looking for trading ideas, check out our Trading Guides.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.