Currency Pair: Bullish AUD/USD

Expertise: Fundamental and technical

Average Time Frame: One week

New DailyFX Quarterly Forecasts for Q3 and are available here

The Australian Dollar has found support at its most recent significant low and been boosted both by comments from its own central bank and hopes for some interest-rate leniency by the US Federal Reserve.

The Reserve Bank of Australia’s latest set of monetary policy minutes was released on Tuesday, and still contained the insistence that the next interest rate move, when it comes will be a rise. The Fed meanwhile will set US monetary policy on Wednesday and market hopes are high that it will signal a hiatus in the currenly regular drum beat of Target Rate rises.

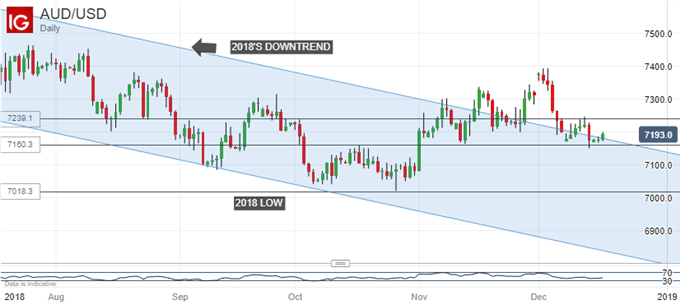

Should this signal come, there could be a further rise in AUD/USD, possibly above the current daily-chart range top which comes in at 0.7239, December 13’s intraday high.

However, gains are likely to be short lived. AUD/USD is already close to resuming the downtrend which has characterized much of this year. It could well get back within that trend before the year bows out. For all the RBA’s confidence, rate futures markets do not even come close to pricing in a single, quarter point rate rise for at least the next eighteen months. This reality will eventually reassert itself, whatever we hear from the Fed this week.

Resources for Traders

Join a free Q&A Webinar and have your trading questions answered

Find out how AUD is viewed by the trading community in real time at the DailyFX Sentiment Page

Strategy not working? Here’s the number one mistake traders make

Just getting started? Check out the DailyFX Beginners’ Guide.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!