New DailyFX Quarterly Forecasts for Q3 and are available here

The Australian Dollar faces considerable fundamental headwinds which are likely to worsen in the days ahead.

Thursday’s vote on an adjournment of the Australian Parliament underlines its political leadership crisis at a time when the Kansas City Federal Reserve’s annual monetary heavyweight symposium at Jackson Hole, Wyoming is likely to see the US central banks’ commitment to higher interest rates for as long as the economics make them plausible underlined.

This will only deepen the already unmissable contrast with the Reserve Bank of Australia. It may well insist that the next move for record low Aussie interest rates, when it comes, will be an increase. But the markets do not now see such a thing coming for all of next year, at least, with inflation stubbornly low and consumer debt equally stubbornly high. With the growth cycle already elderly around the world, we could see Aussie rates on hold for a very long time to come.

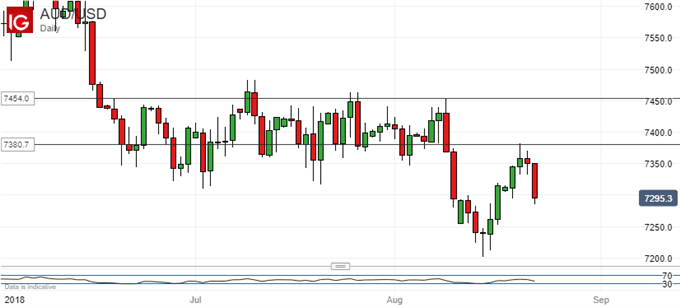

The fundamentally bearish points are now allied to the latest AUD/USD bull run’s failure to reach, never mind top, the 0.7427 level which would have allowed the bulls an opportunity to consolidate their gains from a position of strength.

Focus is now squarely to the downside, with the most recent significant low likely to give way if approached. That comes in at 0.7238 where the pair bounced last week. It is also the lowest point seen since January, 2017.

Should that, too give way, and it all-too-easily could, then focus will inevitably be on new lows in the 0.7030 area, last seen in late 2015.

It would appear that such falls are all too likely now. However, a more dovish than expected performance from Federal Reserve Chair Jerome Powell at Jackson Hole could buy AUD/USD bulls some time, even it it won’t dispel the genuine fundamental question marks over the Aussie. It’s probably also worth keeping an eye on the Australian stock market which, for all the global uncertainties over trade, remains comfortable close to record highs and could be a source of continued Aussie buying.

Stop loss-buy orders around August 21’s peak of 0.7377 might offer good protection against a knee jerk bounce based on this eventuality. The New Zealand Dollar could face similar fundamental and technical weakness but is arguably in a better place than the Aussie on comparisons of the two currencies’ home economies. Buying NZD/AUD modestly at market could also make sense.

Resources for Traders

- Join a free Q&A Webinar and have your trading questions answered

- Find out how AUD is viewed by the trading community in real time at the DailyFX Sentiment Page

- Strategy not working? Here’s the number one mistake traders make

- Just getting started? Check out the DailyFX Beginners’ Guide.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!