USD Technical Outlook

- US Dollar Index (DXY) looks poised to continue correcting

- Support in the low-109s set up to be an important test

- FOMC outcome tomorrow should be quite impactful

US Dollar Technical Analysis Ahead of the FOMC Meeting

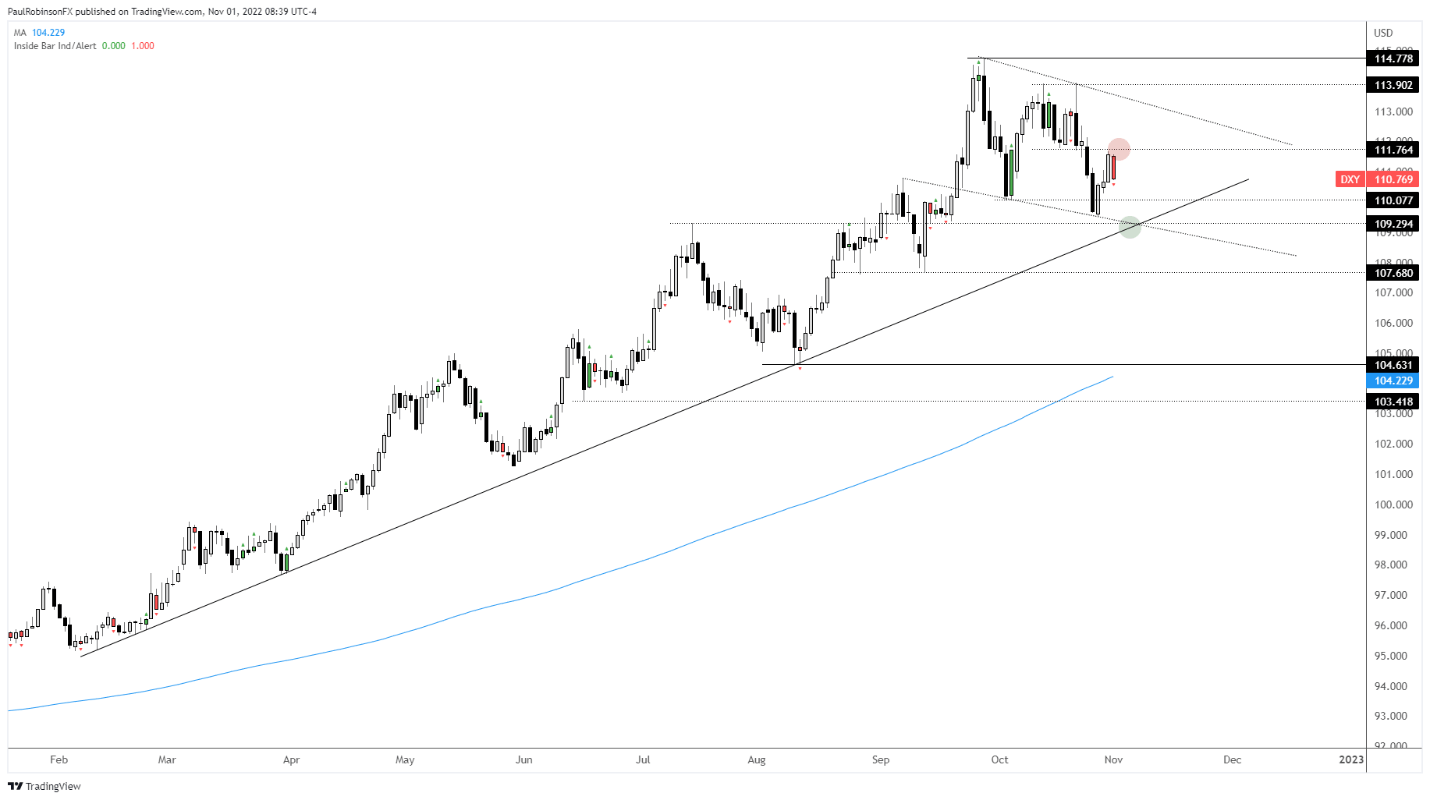

The US Dollar Index (DXY) continues to look vulnerable to more selling as the FOMC outcome nears tomorrow. The overall technical structure is still bearish within the context of a broader uptrend. How far the downward move continues will likely hinge on how support is treated.

Below the recent low there is a slope from early in the year that while not tested on numerous occasions does look sturdy. What helps fortify the trend-line in the low 109s as support is the July high at 10929 and a slope from late September.

A drop into the low 109s and strong rejection, or a breach that is quickly recovered, will keep the DXY downside in check and could signal that the correction is drawing to an end. However, should we see support break then the downside is likely to open up quite a bit.

A break of support could send the DXY down 3-4% more before it finds a low, an outcome we have to be prepared for given how extreme the trend and sentiment was prior to this bout of weakness. Overall, though, the broader uptrend is still up, nothing moves in a straight line.

For now, leaning towards lower levels and a support test at the least. Tomorrow’s Fed outcome could be rather significant in helping determine how levels want to play out.

US Dollar Index (DXY) Daily Chart

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX