View Real-Time SSI Updates via the FXCM Trading Station Desktop

See a video on why we use the Speculative Sentiment Index as a contrarian indicator in our trading

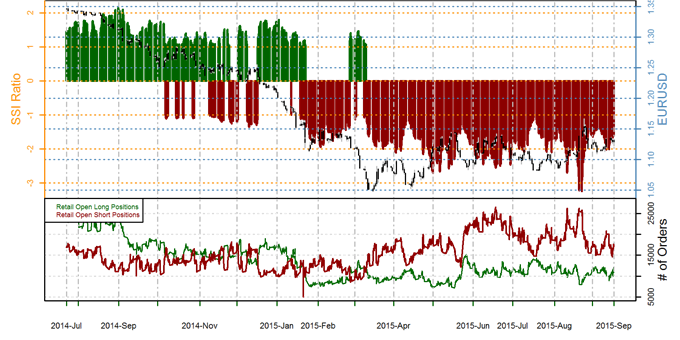

EURUSD – Retail FX traders head into the highly-anticipated US Federal Open Market Committee interest rate decision short the Euro versus the US Dollar. Yet it’s worth noting that traders have actually remained net-short EUR/USD since March when the pair traded near the $1.08 mark. There seems to be little conviction in the current ‘crowd’ position as total open interest has fallen 5 percent since last week. And indeed indecision is obvious as traders hesitate to build large positions amid choppy trading conditions.

There remains modest risk that the Euro may continue its recent gain versus the US Dollar. We would ideally see a much larger build in conviction before taking a strong trading bias, however.

See next currency section: GBPUSD - British Pound May Drop, but We’re Waiting for Bigger Shift in Sentiment

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX