To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

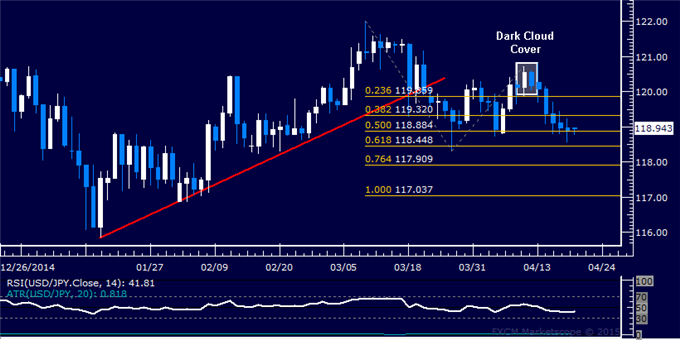

- USD/JPY Technical Strategy: Flat

- Support: 118.88, 118.45, 117.91

- Resistance: 119.32, 119.86, 120.73

The US Dollar declined as expected against the Japanese Yen following the appearance of a bearish Dark Cloud Cover candlestick pattern. A daily close below the 50% Fibonacci expansion at 118.88 exposes the 61.8% level at 118.45. Alternatively, rebound above the 38.2% Fib at 119.32 opens the door for a challenge of the 23.6% expansion at 119.86.

Prices are wedged too closely between near-term support and resistance levels to justify taking a trade on a long or short side from a risk/reward perspective. With that in mind, we will continue to stand aside until a more attractive opportunity presents itself.

Add these technical levels directly to your charts with our Support/Resistance Wizard app!

Daily Chart - Created Using FXCM Marketscope

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com