To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- NZD/USD Technical Strategy: Flat

- Prices Trying to Rekindle Upside Momentum After Finding Support Near 0.67 Figure

- Bearish Candlestick Pattern Still Technically Valid Despite Lackluster Follow-Through

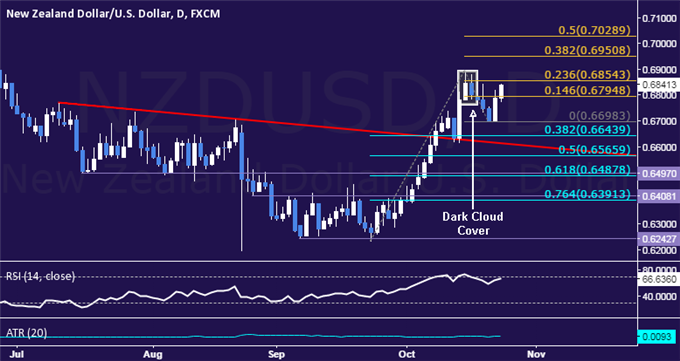

The New Zealand Dollar is attempting to launch a recovery after finding support near the 0.67 figure against its US namesake. Downside follow-through after the formation of a bearish Dark Cloud Cover candlestick pattern has proved lacking, though the pattern remains technically valid absent a close above its swing high.

A daily close above the 14.6% Fibonacci expansion at 0.6795 opens the door for a challenge of the 23.6% level at 0.6854. Alternatively, a reversal below the October 21 low at 0.6698 clears the way for a test of the 0.6613-44 area, marked by the 38.2% Fib retracement and a recently broken falling trend line (now recast as support).

Current positioning does not offer an attractive trading opportunity. On one hand, prices are too close to resistance to justify a long position from a risk/reward perspective. On the other, the absence of bearish follow-through suggests taking up the short side is at best premature. With that in mind, we will remain on the sidelines for the time being.

Losing Money Trading Forex? This Might Be Why.