AUD/USD FORECAST: AUSTRALIAN DOLLAR CRUMBLES AS USD PRICE ACTION RECOLS

- The US Dollar has risen considerably against its Australian Dollar peer as the coronavirus outbreak infects risk appetite

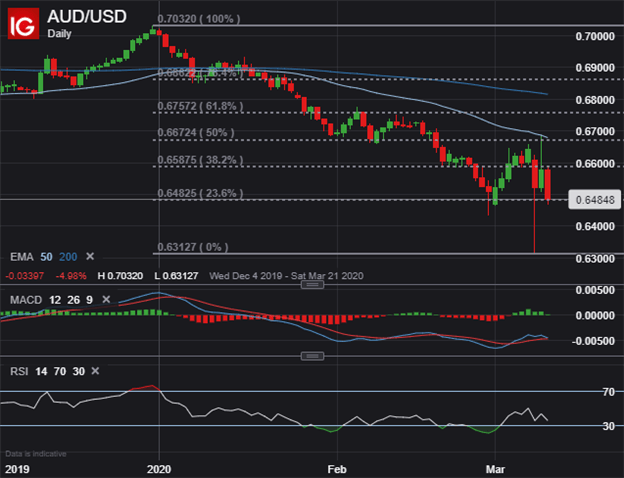

- AUD/USD price action has plunged over 200-pips since touching its 50-day exponential moving average

- Broad based weakness in the Australian Dollar may continue and pressure spot AUD/USD toward lows printed during 2008 amid the global financial crisis

AUD/USD price action has whipsawed over the last several hours alongside an abrupt return of currency volatility. The Australian Dollar notched a considerable recovery relative to other major currency pairs since the Aussie took a massive spill at Sunday’s open.

| Change in | Longs | Shorts | OI |

| Daily | -8% | -4% | -7% |

| Weekly | -3% | 49% | 4% |

The rebound attempt in the Australian Dollar appears to have faded, however, as the pro-risk Aussie falters while the Greenback gains back previously lost ground. This development follows a rejection in spot AUD/USD price action at its 50-day exponential moving average.

AUD/USD PRICE CHART: DAILY TIME FRAME (DECEMBER 2019 TO MARCH 2020)

AUD/USD prices topped out slightly below the 0.6700 handle during a relief bounce off its lowest intraday reading since March 2009. The initial plunge lower in spot AUD/USD followed the resumption in trading this week after last week’s market panic snowballed into a rout on risk appetite. This was exacerbated over the weekend following the latest coronavirus news and an oil price war sparked by Saudi Arabia.

Spot AUD/USD is currently perched around the 0.6485 mark, which roughly aligns with technical confluence highlighted by the 23.6% Fibonacci retracement level of the forex pair’s year-to-date trading range. That said, if the Australian Dollar slips beneath its March 01 swing low around the 0.6465 mark, the Aussie might look to re-test its March 08 swing low near the 0.6310 price.

AUD/USD PRICE CHART: MONTHLY TIME FRAME (JULY 2007 TO MARCH 2020)

The standing month-to-date low printed on March 08 is officially probing monthly lows recorded during late 2008 and early 2009 in the midst of the global financial crisis. This critical zone of technical support could help spot AUD/USD price action stabilize from its steep slide since the beginning of 2018.

The growing prospect of further monetary policy accommodation from the Federal Reserve, which follows an emergency FOMC rate cut last week, could provide a fundamental catalyst that may help the Australian Dollar recover lost ground relative to its USD peer.

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight