To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- USD/CAD Strategy: Flat

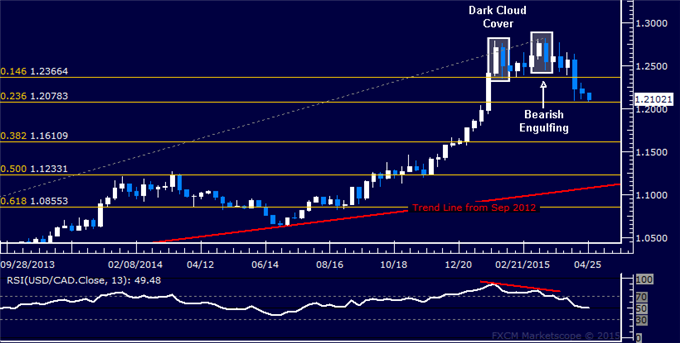

- Pullback Tests Support Below 1.21 Mark

- Waiting for Signal to Enter Long Trade

The US Dollar reversed downward against its Canadian namesake as expected having produced bearish Dark Cloud Cover and Bearish Engulfing candlestick patterns coupled with negative RSI divergence. A break below the 23.6% Fibonacci retracement at 1.2078 exposes the 38.2% level at 1.1611. Alternatively, a reversal back above the 14.6% Fib at 1.2366 targets the March swing high at 1.2834.

The dominant long-term USD/CAD trend continues to look bullish. With that in mind, we will look at further losses as corrective and treat them as an opportunity to enter long at more attractive levels once the pullback is exhausted.

Weekly Chart - Created Using FXCM Marketscope

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com