To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

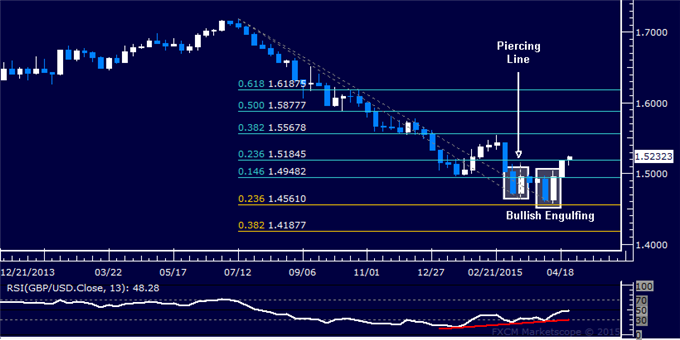

The British Pound turned higher against the US Dollar as expected after prices put in a Bullish Engulfing candlestick pattern coupled with positive RSI divergence. From here, a push above the 23.6% Fibonacci retracement at 1.5185 exposes the 38.2% level at 1.5568. Alternatively, a reversal back below the 14.6% retracement at 1.4948 targets the 23.6% Fib expansion at 1.4561.

The overall GBP/USD trend continues to look bearish. With that in mind, we will treat any further gains as corrective and look to them as an opportunity to establish a short position at more attractive levels once the upswing is exhausted.

Weekly Chart - Created Using FXCM Marketscope

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com