Talking Points:

- AUD/USD Strategy: Flat

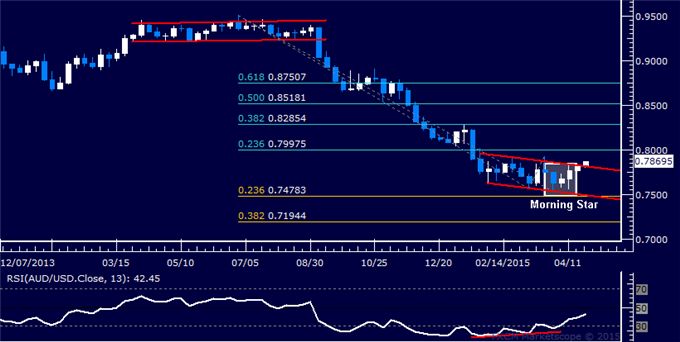

- Aussie Tries to Make Good on Bull Signal

- Upswing to Yield Short Trade Opportunity

The Australian Dollar is trying to make good on upside reversal cues established by the formation of a bullish Morning Star candlestick pattern. Breaking channel top resistance at 0.7806 initially exposes the 23.6% Fibonacci retracement at 0.7998. Alternatively, a reversal below the intersection of channel floor support and the 23.6% Fib expansion at 0.7478 targets the 38.2% threshold at 0.7194.

The overall AUD/USD trend continues to look bearish. With that in mind, we will treat any further gains as corrective and look to them as an opportunity to establish a short position at more attractive levels once the upswing is exhausted.

Weekly Chart - Created Using FXCM Marketscope

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com