Talking Points:

- The World Gold Council reported gold demand rose 8% in the 3Q year-over-year

- Aggregate consumption in China and India increased by 13% in both countries

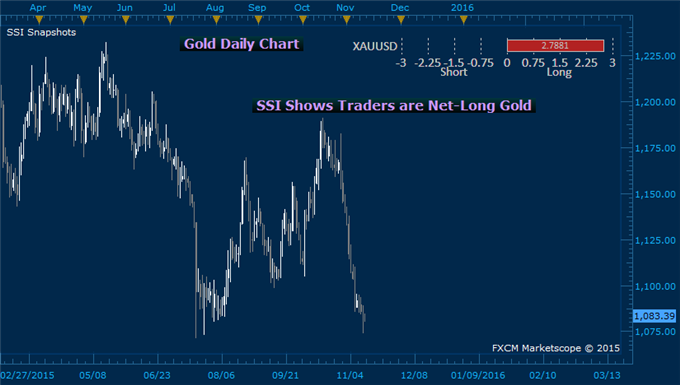

- The FXCM SSI indicator shows retail traders are net-long nearly 3 to 1 on the precious metal

See how retail traders are positioning in the majors in your charts using the FXCM SSI snapshot.

The World Gold Council, an industry leader in analyzing gold trends, reported that the precious metal is monitors witnessed an 8 percent jump in demand through the third quarter. The group noted that consumption was up to 1,120.9 metric tons though the period compared to 1,041.9 metric tons in the same period last year. Despite the raw material seeing greater demand amongst retailers, prices fell 2 percent over the same time frame.

Much of the demand for the commodity came from its two largest buyers, China and India. Jewelry demand for gold in China and India increased 4 percent and 13 percent respectively with aggregate consumption rising by 13 percent in both countries.

A key impending event risk that may alter the markets’ attitude towards the commodity is the Federal Reserve’s December rate decision. If the central bank hikes interest rates, dollar-denominated assets - such as US bonds - will redirect funds away from gold and towards assets with a higher return. That may very well bolster the greenback and thereby weigh this and other commodities priced using the currency. The current implied probability for the FOMC to normalize monetary policy at its next meeting is 70 percent using Fed Fund Futures.

FXMC offers a free indicator for retail traders to analyze the bias of the markets. The Speculative Sentiment Index (SSI) is a technical indicator that shows the ratio of short-long trades. Currently the SSI shows that investors are net long gold relative to the US Dollar.