Talking Points:

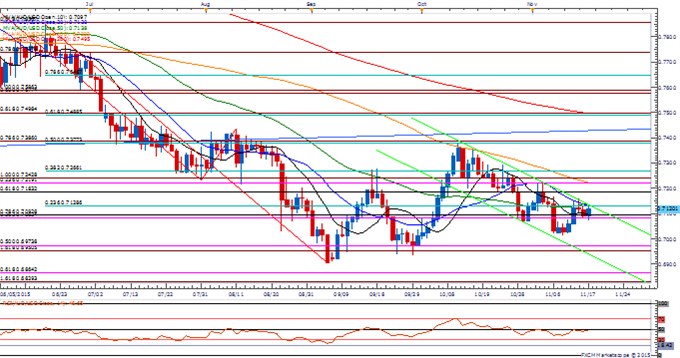

- AUD/USD Outlook Mired by Downward Trending Channel Despite Wait-and-See RBA Policy.

- NZD/USD Struggles Following 11% Decline in Milk Power Auction; 0.6400 in Focus.

- USDOLLAR Continues to Carve Higher Highs & Lows Following Bullish Breakout.

For more updates, sign up for David's e-mail distribution list.

Chart - Created Using FXCM Marketscope 2.0

- Even though the Reserve Bank of Australia (RBA) Minutes endorses a wait-and-see approach, AUD/USD may continue to track within the downward trending channel carried over from the previous month as the pair retains the opening monthly range despite the positive developments coming out of the Australian economy.

- Will keep a close eye on Australia’s Wage Price Index (WPI) amid the ongoing improvement in the labor market, but failure to hold/close above the Fibonacci overlap around 0.7080 (38.2% expansion) to 0.7090 (78.6% retracement) to favor a further decline in the exchange rate especially as the RBA keeps the door open for another rate-cut.

- The DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-long AUD/USD since May 15, but the ratio continues to come off of its recent extremes as it narrows to +1.96, with 66% of traders long.

NZD/USD

- NZD/USD extends the decline from earlier this week as Whole Milk Powder prices slipped another slipped another 11.0% at the Global Dairy Trade auction; will keep a close eye on New Zealand’s Produce Price Indices (PPI) amid the slowdown in global growth accompanied by the ongoing weakness in commodity

- Downside targets remain favored as the pair fails to retain the range from last week and search for support, with price & the Relative Strength Index (RSI) largely preserving the bearish formations carried over from October.

- Will watch former resistance around 0.6370 (50% retracement) to 0.6400 (61.8% retracement) for near-term support.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

USDOLLAR(Ticker: USDollar):

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 12180.74 | 12201.74 | 12167.69 | 0.00 | 71.95% |

Chart - Created Using FXCM Marketscope 2.0

- USDOLLAR may extend the advance from earlier this week amid the recent series of higher highs & lows in price, while market participants largely anticipate the Federal Open Market Committee (FOMC) to remove the zero-interest rate policy (ZIRP) at the December 16 rate decision.

- With the FOMC Minutes on tap, signs of a greater dissent within the committee may heighten the appeal of the greenback and spur a test of the monthly opening range amid growing bets for a Fed rate-hike.

- Topside targets remain favored for USDOLLAR with the next region of interest coming around 12,273 (161.8% expansion) to 12,296 (100% expansion).

Read More:

Price & Time: Gold – Can It Get Out Of Its Own Way?

EUR/JPY on the Cusp of Important Move

US DOLLAR Technical Analysis: Set To Hold Key Support

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand