Fundamental Forecast for Japanese Yen: Neutral

- ECB Move Drives EURUSD to 11-Year Low, EURJPY On the Edge

- USD/JPY 1 Month into Consolidation; Could be a Triangle

- For Real-Time SSI Updates and Potential Trade Setups on the Japanese Yen, sign up for DailyFX on Demand

The fundamental developments due out next week may undermine the bullish forecasts surrounding USD/JPY should the Federal Open Market Committee (FOMC) scale back its hawkish tone for monetary policy.

Despite growing expectations for a Fed rate hike in mid-2015, the rotation within the voting committee may spur a material shift in the forward-guidance for monetary policy, and the central bank may sound increasingly cautious this time around amid the fresh batch of monetary support from the Swiss National Bank, European Central Bank and Bank of Canada. Indeed, the Fed may not way to get too far ahead of its major counterparts as it struggles to achieve the 2% target for inflation, and Chair Janet Yellen may show a greater willingness to further delay the normalization cycle especially as the advance 4Q Gross Domestic Product (GDP) report is expected to show the economy growing an annualized 3.2% versus the 5.0% expansion during the three-months through September.

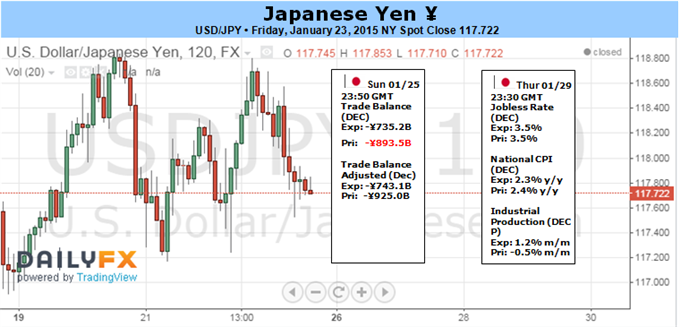

At the same time, Japan’s Consumer Price Index (CPI) may also fail to encourage a bullish outlook for USD/JPY as the Bank of Japan (BoJ) continues to endorse a wait-and-see approach for monetary policy, and the pair remains at risk for a larger correction over the near-term as Governor Haruhiko Kuroda remains confident in achieve the 2% inflation target over the policy horizon. In turn, USD/JPY may continue to carve a sting of lower-highs going into February should the data prints drag on Fed interest rate expectations.

With USD/JPY struggling to push back above the 119.00 handle, the pair faces a risk for move back towards near-term support around the 117.00 handle, and the dollar-yen may make a more meaningful run at the January low (115.84) should the bullish sentiment surrounding the greenback fizzle.