Talking Points:

- Gold interests returned, breaks correlation to other safe havens

- Oil retraced after knee-jerk fears on prospective Iranian oil

- Copper rallied on China’s moves to keep yuan stable

Risk assets staged a small rally in the morning Asia following oil’s retracement from recent bottom at 28.36. China central bank PBoC confirmed the weekend news that foreign banks are now subject to required-reserve-ratio (RRR) on offshore yuan (CNH) deposits. This policy aims to stabilize the currency thus initiated strength in yuan and broad domestic market.

Oil price sank to a fresh low of 28.36 before Asia market open due to news of Iran’s sanction being lifted on Sunday. Both WTI and Brent quickly retraced up to Friday’s close before settling in the proximity, while still subject to macro volatility.

Brent oil could look to lower prices as Gulf and OPEC exporters reel from an entry of Iranian oil. Iran’s deputy oil minister reportedly said on Sunday that the country aims to bring output to 500,000 barrels a day.

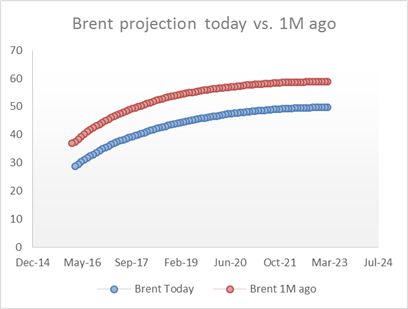

Projected Brent prices over 7 years ahead have shifted lower and flatter today versus a month ago.

Copper price rallied over 1 percent today as part of an oil-led Asian rally, prior to the all-important China’s GDP report tomorrow. The moves by China to reduce offshore-onshore yuan gap (CNH-CNY spread) via wider RRR application, and today’s stronger CNY fix, proved positive to industrial metals. Stronger, more stable yuan will increase China’s purchasing power and might boost demand.

Gold price holds on to Friday’s recovery, resiliently so in the face of a small Asian rally. A risk flight immediately prior to current retracement may account for these lingering interests. Moreover, gold seems to detach from the retreat of safe haven currencies like JPY, CHF, a sign that investors’ optimism may build up again. Bloomberg data shows an increase in gold holdings via SPDR, ETF, and iShare over the last week, and last month.

GOLD TECHNICAL ANALYSIS – Gold price ticked up on a second day today as momentum bounced. Range trading prevails between a recent bottom at 1071.57 and top of early 2016 rally at 1113.08. Near-term bias is focused on upside, until momentum signals indicate otherwise.

Daily Chart - Created Using FXCM Marketscope

COPPER TECHNICAL ANALYSIS – Copper price trades sideways on a third day despite intraday volatility and a fresh multi-year low at 1.9355. On a daily basis the metal remains fragile to downward pressure, so long as new lows are established frequently. Resistance at top is around 2.0020 past support and also 10-day moving average.

Daily Chart - Created Using FXCM Marketscope

CRUDE OIL TECHNICAL ANALYSIS – WTI oil retraced up to previous close, after knee-jerk reaction to upside supply risk led to a new low at 28.36. Oil is the weakest link among commodities at the moment, with little built-up momentum. Hence further descent is not ruled out. The bears could let stops trail resistance and 10-day moving average at 31.83.

Daily Chart - Created Using FXCM Marketscope

--- Written by Nathalie Huynh, Currency Strategist for DailyFX.com

Contact and follow Nathalie on Twitter: @nathuynh