Talking Points

- When markets pullback from the trend consider trading retracements

- Traders can time entries at support and resistance using oscillators

- Manage risk over previously market swing highs or lows

Scalpers have a variety of choices when it comes to an execution strategy. This decision should be decided after carefully evaluating current market conditions for the currency pair of their choosing.

Today to continue the Definitive Guide to Scalping, we will focus on trading retracements and pullbacks in price from the primary trend.

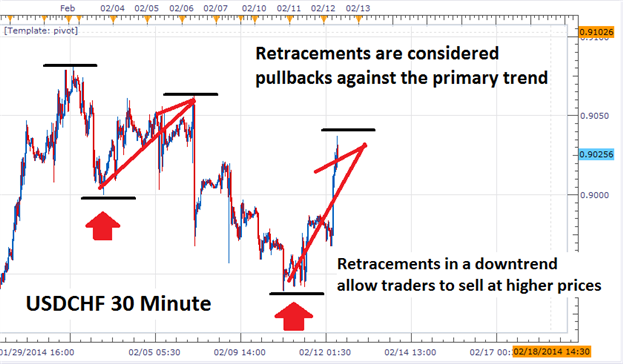

Learn Forex – USD/CHF retraces in a downtrend

(Chart Prepared by Walker England)

Trading a Retracement

As a retracement trader our first task is to identify the trend. This can be done through a variety of methods mentioned in the 2nd installment of the Definitive Guide to Forex Scalping. In the event that price is trending downwards, retracement traders will look to sell the market after price retraces, which means the market has moved temporarily against the primary trend. Likewise in the event that price is trending upwards, traders would wait for prices decline before buying towards a higher high. Above we can see a series of retracements on the USD/CHF currency pair offering selling opportunities.

Once a retracement is found, it’s time to begin planning where to enter the market. The easiest way to do this is to place entry orders near a converging level or either support (to buy in an uptrend) or resistance (sell in a downtrend). Below we have an example of this technique in practice. Displayed you can see resistance in the form of a trendline as well as a 78.6% Fibonacci retracement line. Traders can look to sell the market at this point near .9035. Risk should be monitored above resistance to close positions in the event of a price breakout, and finally profit targets should be set towards lower lows.

Learn Forex – USD/CHF Support & Resistance

(Chart Prepared by Walker England)

Retracements with Oscillators

Traders can also choose to enter retracements through the use of an oscillator. Similar to trading a range should wait for price to reach a key level of support or resistance prior to considering an entry. Once this occurs, traders can turn to an indicator such as MACD, CCI, or RSI to time their entry. In a downtrend, such as the $USDCHF example depicted above, traders will wait for momentum to return to the downside prior to entering in the market.

Trading with an oscillator can potentially help trader’s better find market momentum returning back in the direction of the primary trend. Below we can again see the USD/CHF 30 minute chart, but this time the RSI indicator has been added to the graph. Price has moved off of resistance, but oscillator traders will wait for RSI to close below an overbought value prior to entering into the market. Once a trade is placed we should again evaluate our positions exits. Even when trading with a confirming oscillator a stop should be used!

.

Learn Forex – USDCHF & RSI Oscillator

(Chart Prepared by Walker England)

Overall, trading retracements is an exciting way to approach scalping. It should be noted however that retracement trading is all about timing and may not be for everyone! The key to retracement strategies starts with becoming comfortable at pinpointing pullbacks in the market and managing risk appropriately.

This concludes the 6th installment of The Definitive Guide to Scalping. Next week we will examine breakouts as we continue our look at scalping strategies. If you have missed any of the previous editions of this scalping guide, you can catch up on all the action with the previous articles linked below.

The Definitive Guide to Scalping, Part 1: Market Conditions

The Definitive Guide to Scalping, Part2: Currency Pairs

The Definitive Guide to Scalping, Part 3: Time Frames

The Definitive Guide to Scalping, Part4: Support & Resistance

The Definitive Guide to Scalping, Part5: Scalping Ranges

The Definitive Guide to Scalping, Part6: Scalping Retracements

The Definitive Guide to Scalping, Part7: Scalping Breakouts

The Definitive Guide to Scalping, Part8: Risk Management

---Written by Walker England, Trading Instructor

To contact Walker, email instructor@dailyfx.com. Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information.