Traders are often governed within the competing emotions of greed and fear, struggling to find the right balance to get the results that they want. Nowhere is this struggle more apparent than when it comes to the topic of managing profitable trades.

What if price reverses – wiping away all of our profit before running directly to our stop?

Or perhaps we decide to just close the position – take our profit off the table. Well, what if price would have continued to go up? We just missed out on all of those pips and instead we are looking at this measly profit merely because we were scared of losing it.

This article will examine a mechanism by which traders can strike a happy medium during strong trends; and move forward confidently without every worrying about the ‘what-ifs’ of trade management.

Identifying Support and Resistance with Swing-High and Low’s

In Price Action Swings, we looked at a way in which traders can identify support and resistance based on the study of price action.

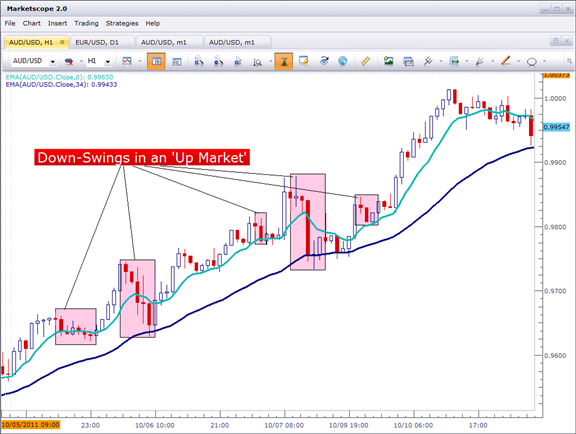

During up-trends, price will often make a series of ‘higher-high’s’ and ‘higher-lows.’ The picture below will illustrate:

(Created by J. Stanley)

During downtrends, price will often make a series of ‘lower-high’s’ and ‘lower-lows.’ You can see these swings identified below:

(Created by James Stanley)

And of course, when the market is ranging – price will often stay within Support and Resistance levels that can, once again, be identified by price action. The following picture shows some of the swing-highs and swing-lows identified during a ranging market:

Match Trade Management to the Trading Strategy

Since price action takes on different roles depending on whether the market is trending or ranging, it often behooves the trader to attempt to match their risk management to the market environment.

This article is specifically addressing trends, as they offer a comfortable mechanism of risk management to price action traders.

When a trader is looking to take part in an up-trend, they want to see higher prices to take their trade into profitability.

If price happens to reverse after the trade was entered, establishing a new short-term low, the trader may want to stop out of the position (as the pair may continue making new lows while you are holding a long position.) The graphic below will illustrate with more detail.

(Created by J. Stanley)

In the above chart, each swing low is identified with a small black line – and these are the areas that traders holding long positions can look to adjust stops to.

As long as this strong up-trend stays intact, the pair continues to make higher-highs and higher-lows, and this allows the trend trader a mechanism of risk management.

The red text highlights when price had gone on to establish a new low; and as you can see that allowed the trader to close their position before the pair went on to face considerable congestion.

This same type of mechanism can be done with downtrends. The chart below will illustrate further.

(Created by J. Stanley)

During down-trends, as lower-lows and lower-highs are established, this gives the trader the opportunity to adjust risk to a price slightly above the swing-highs that are established.

When the recent swing high is pierced (as you can see towards the right side of the above chart), establishing a new intermediate-term-high, the trade will automatically be closed.

A Note on Opportunity Cost

The most difficult part about teaching (or learning) trade management is the idea of opportunity cost: The concept that we may close the trade at a loss and then price might turn around and actually move in our direction.

This causes many new traders to keep many positions open far longer than they probably should. As a matter of fact, this was one of the chief findings in The Number One Mistake that Forex Traders Make; traders will often take far bigger losses when they are wrong than what they will gain when they are right.

Much of this comes from basic human psychology: Our desire to be ‘right.’ We don’t want to admit that we are wrong for the simple fact that we have to admit that we weren’t right.

But I want to leave you with this question:

Are you going to accomplish all of your goals, dreams, and aspirations with this one trade?

Probably not.

A wise man once told me that each trade should be but one of thousands in a professional trader’s career. This game is a marathon, not a race.

And if you are trading in an up-trend, and price makes a new low – do you really want to stick around ‘hoping’ that price might turn around and give you what you want? Or would you rather absorb a small loss in a position in which you’ve already been proven wrong, so that you can look for greener pastures elsewhere?

Trading in strong trends and trailing stops with swing lows can help traders absorb small losses at the point at which they are proven wrong; with the potential of being able to maximize up-side gains when they are right.

--- Written by James B. Stanley

To contact James Stanley, please email Instructor@DailyFX.Com. You can follow James on Twitter @JStanleyFX.

To join James Stanley’s distribution list, please click here.