Talking Points

- Based on liquidity, not all currencies are matched for trading

- Two USD currency pairs can be linked to create a third synthetic pair

- Be creative in your synthetics but always monitor spreads and interest

It is imperative that new traders in the Forex market become familiarized with currency pairs and The Majors. While this is always a good place to begin your learning, what happens when you want to trade a non USD currency cross? If you are looking to trade pairs such as the exotic EUR/MXN (Euro / Mexican Peso), the answer will be through the use of a synthetic currency pair.

To help, today we will review the basics of a Synthetic currency pair and how you can create your own inside of your trading platform.

Synthetic Currency Pairs

So what exactly is a synthetic currency pair? A synthetic currency pair is one that is not listed, or not carried by brokers and other liquidity providers. Normally these pairs are not carried due to thin trading activity as a result from limited economic activity and capital flows between the two respective economic regions. However, even though a currency pair isn’t listed doesn’t mean you can’t create your own! A synthetic currency pair is created when we use two alternative pairs to create a third unique currency pair!

Now let’s learn how to create a synthetic currency of our own.

Creating a Synthetic

Traders can create virtually any Synthetic currency through trading two separate USD positions. For example earlier in the article, we mentioned a trader may want to trade the EUR/MXN currency pair. While this pair is not actively quoted, it can be replicated by trading both the EUR/USD and USD/MXN currency pairs.

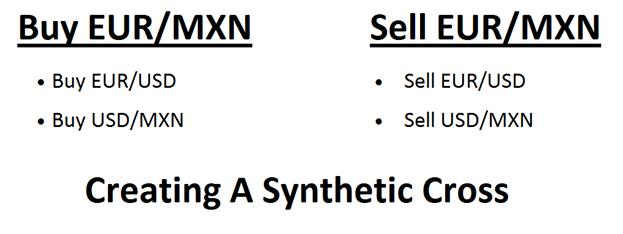

In this scenario, if a trader wants to BUY the EUR/MXN, the EUR/USD should be bought putting the trader Long Euros and Short US Dollars. Then the USD/MXN can also be bought, adding a Long US Dollar position and Short Peso position in the mix. Once this is done the Dollar positions effectively cancel each other, leaving the trader Long Euros and Short Pesos!

As seen in the image below, this process can be replicated to also create a synthetic Sell position on the EUR/MXN.

Costs of Trading Synthetics

As with any currency transaction there is a spread associated with creating a synthetic currency trade. Since you are opening two individual positions to create a third synthetic trade there will be a spread associated with each transaction. As well traders should consider the interest rate differential between the countries they are trading between. Since there are three countries involved in a synthetic currency transaction this should be monitored as it may negative or positively affect the trade’s profitability.

---Written by Walker England, Trading Instructor

Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information.