Article Summary: We found that a key trait of our successful Forex traders is trading during the Asia trading session, which is more of a range bound market. A simple tool to trade this type of market is the Relative Strength Index (RSI), but first we will learn how to easily identify the Asia trading session.

A popular topic of discussion on DailyFX.com is our study on the Traits of Successful Forex Traders. In this study we discovered that most of our Forex traders were more successful when trading during the Asian trading session. In this article we will discuss how to identify the Asia session on your chart, how to use the Relative Strength Index (RSI) to pick entries and how to pair the two ideas together to produce higher probability signals.

When is Asia?

The Asia session is normally defined between the hours of 5pm to 3am Eastern Time which include Sydney and Tokyo trading hours. During this time there is typically low volatility in the market which means it can be an ideal time to exploit potential price ranges.

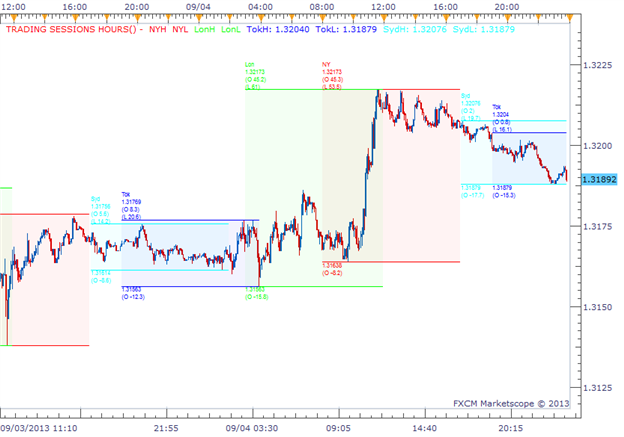

Learn Forex: The Trading Session Hours Indicator

(Created using the Trading Session Hours Indicator - Click here to down this indicator for free.)

(Marketscope 2.0 Charting Package - Free Demo)

This chart clearly splits up the different trading sessions so you can better identify the session you want to trade. There are 4 main FX trading hubs in the world; London, New York, Sydney andTokyo, and since we are wanting to trade the Asia trading session, we want to focus on the Sydney andTokyo sessions. You can see in the chart above how much narrower the Sydney and Tokyo sessions' price ranges are. This will be the time of day that is best to look for ranges based on our research data. Next, to generate our trade entries, we will be using the RSI.

Reading the RSI Signals

The RSI is displayed as a value between 0-100, where values above 70 are considered overbought and values below 30 are considered oversold. We want to pay close attention when the RSI surpasses either of these values because that means a trading signal is near. Our trade is triggered when the RSI crosses back below the 70 or crosses back above the 30. See the chart example below.

Learn Forex: Trading RSI Signals

Here are two signals the RSI generated for us, a sell signal followed by a buy signal. You can see it did a pretty good job at signaling when the top and bottom began to turn during this price range.

DailyFX has many resources that teach how to filter common signals into higher probability strategies. If you want to learn how else you can filter RSI signals, we invite you to take our free online RSI video course (approx. 10 minutes).

Now that we understand these concepts, we will put these two ideas together to form a cohesive strategy.

Example of Signals During Asia Session

As we've learned, the RSI performs well in ranging markets. So if you see price oscillating up and down and in a confined range, this is a great time to use the RSI. During the Asian trading session, we've learned that we will often see this type of price action. So let's take a look at a chart using both tools.

Learn Forex: Trading the RSI during a Ranging Market

This example is a 5-minute chart of the GBP/USD. You should first notice that we drew two vertical lines to rope off the Asia trading session that we are wanting to trade. We only want to take trades during the Sydney and Tokyo time blocks. Next, we look for the RSI to provide us with our entry signals. Notice the two signals provided during this Asia session, an early sell signal and later a buy signal. The RSI provided both of these successful entries during this ranging market almost perfectly. These are the type of setups we are looking to take advantage of and are fairly easy to spot once you've practiced a few times.

Range Trading the Asia Trading Session

You should now be comfortable with employing this strategy as well as understand the logic it is based on. We've learned that most of our traders are more successful when they trade during the Asia trading session (a ranging market environment). And we also learned that the RSI can be an effective tool to pick tops and bottoms in ranging markets. Therefore, combining these two ideas could produce a more consistent Profit/Loss on our account. Good luck with your trading!

---Written by Rob Pasche

To contact Rob, email rpasche@dailyfx.com.

Sign up for my email list to stay up to date with my latest articles and videos.

Looking to learn more strategies and test your overall technical analysis knowledge? Check out our FREE Trade Like a Professional certificate course. (approx. 2 hours)